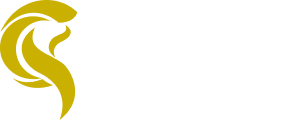

The demand of the clean energy rises in recent years, not to mention the industry or commercial sectors’ demand. Multinational companies have joined in a 100% renewable energy supply commitment, called RE100. Listed companies have reached 155 companies to date, which include Apple, IKEA, Nike, Nestle, Unilever, and Google. As seen in Figure 1, the total energy demand of its members reaches 159 MWh per year, which is higher than Malaysia electricity consumption [1]. This commitment drives the need of RE for big companies, both in the industrial and commercial sector. Harnessing this demand, by exploiting Indonesia’s large RE potential, will opens potential investments in industrial and commercial sectors from such companies. There are some approaches to fulfill the demand [2]. The first approach is to install an on-site RE generator, such as a solar PV system. However, this approach faces an issue regarding the land requirement for installing the system with sufficient capacity. The second approach is by utilizing off-site power generation. This approach requires a mechanism or scheme to purchase electricity from a generator located outside of the site. As investing on a transmission network is costly for an industry, a scheme of renting existing utility transmission can be a solution. This scheme is called power wheeling.

Figure 1. Re100 Companies’ Energy Demand per Year (Source: Re100, 2018)

Power wheeling is an approach to collectively utilize the electricity network through an open access to electricity transmission and distribution networks. The approach enables the user to purchase electricity from other sources than its own on-site generator. Power wheeling allows electrical customers, for example, an industry, to buy electricity from a private generator located outside of its area. Hence, it enables diversification of electricity source to the customer as the customer could choose its electricity supplier. Additionally, its implementation requires the customer to pay the charge for the network utilization.

Despite its advantages, the implementation of power wheeling faces both technical and economic challenges. The first technical challenge is the congestion of the network. Heavily loaded transmission network restricts additional generators to be integrated into the system. The safe operation of the network is constrained by the network’s thermal capacity and voltage. Additional integrated generators cause power flow changes in the network which may overload constrained lines in the network. Furthermore, operation voltage constraint may also be exceeded if the network is heavily loaded. Another issue is network line losses which are proportional to the square of line current. The implementation of power wheeling can increase the transmission line current which substantially causes significant line losses. Hence, power flow analysis is strongly required prior to the integration of generators to the network by power wheeling.

Moreover, economic consideration also surrounds the implementation of power wheeling. The open access practice allows customers to purchase electricity energy from another producer than the utility-owned generation. It weakens the utility monopoly power and enhances competition between the utility and private investor [2]. The financial challenge also arises in the scrutiny process of determining the wheeling charges as there are various method and bases for its determination. Thus, the implementation of power wheeling should consider its objectives and economic impact which may differ among countries regarding its various condition.

In the context of green energy, power wheeling could also play a role in increasing renewable power to the system. Some countries implement renewable energy certificates to achieve their renewable power targets, such as Renewable Obligation (RO) in the United Kingdom, Renewable Portfolio Standard (RPS) in the United States, and Renewable Purchase Obligation (RPO) in India [3]. In a deregulated power market, the RE quota obligates utility to meet a certain percentage of generation from renewable energy sources. Power wheeling concept can be an enabler to the quota regulation. It allows RE generators to site in the most cost-effective location regardless of the obligation to serve the entity’s load on its site. Through this concept, customers can fulfill their RE power supply from other regions, not only from their on-site RE power plant. For example, an industry located near the shore is permitted to purchase a geothermal powered generator through third-party transmission and distribution network. This will possibly push the growth of RE generator located far from load center and help the utility to meet its RE quota. However, to successfully exploits the power wheeling benefit, the utility requires to have an extensive transmission and distribution networks to reach out wider service area and RE potential.

The implementation of power wheeling in various countries can be traced to 20 years ago. In 1998, the United States started to provide open access to its T&D asset as regulated by Open Access Transmission Tariff (OATT) by issuing Order 888. It requires all public utilities that own, control or operate electricity transmission facilities to open access non-discriminatory transmission tariffs. The open access urgency was also motivated by the inability of renewable generators to sell their power to their promising or favorable market but their nearest utility [5]. In Mexico, power wheeling was established as an instrument to increase renewable generation projects after the enactment of RE Act in 2008. The regulation poses a different wheeling fee for RE generators by a postage-stamp rate which uses a fixed rate regardless of the distance between generator and load center. This results in lower wheeling fee than conventional energy sources [5]. Different wheeling charging scheme is implemented in India by the capacity-based charge. Its implementation disadvantages RE generators as intermittency of RE source lower the utilization factor of RE generators [5]. Hence, it makes the wheeling charge of RE generators significantly higher than a conventional one.

In Indonesia, privatization in electricity business started in 1992 when the government permitted private investment in the generation following the electricity crisis. The enactment of Presidential Decree No. 37/2012 allows private investment, called Independent Power Producer (IPP), to be involved in the power generation to work out the electricity shortage [4]. However, access of private sector in T&D only granted after the enactment of Government Regulation No. 14/2012. PT. PLN, as the sole owner of transmission and distribution (T&D) network in Indonesia, held to only right to operate the T&D business in the country. However, private sector access in transmission and distribution is permitted following the enactment of Government Regulation No. 14/2012. The regulation obligates the electricity transmission business to open access to its asset for public interests. Meanwhile, power wheeling is specifically regulated by Regulation of MEMR No. 1/2015, which let the Independent Power Producers (IPPs) and Private Power Utility (PPUs) to utilize PT. PLN’s T&D asset to sell their power to their customers. However, no detailed technical and financial document on power wheeling are issued following its enactment.

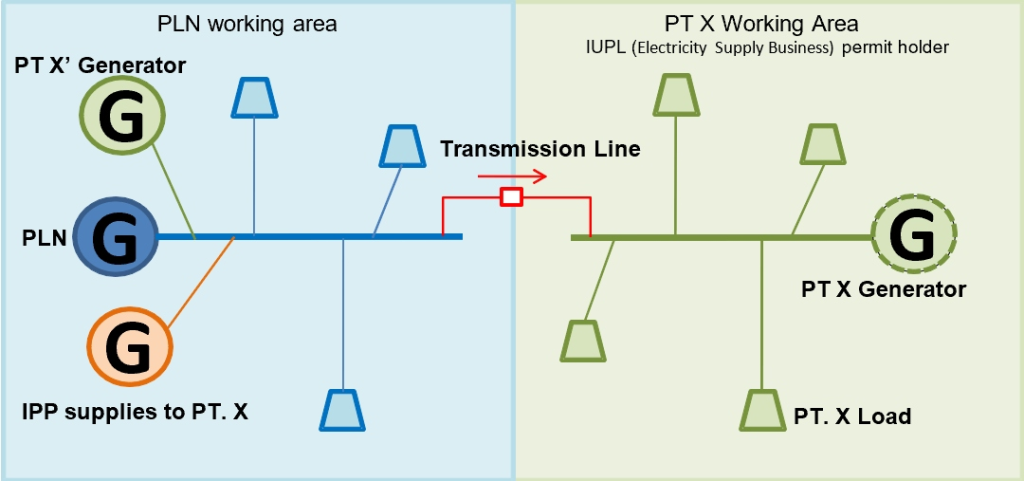

Figure 2. Power Wheeling Scheme in Indonesia (Source: ESDM, 2014)

In Indonesia, the implementation of power wheeling will serve the industry by two concepts. The scheme of power wheeling implementation in Indonesia can be seen in Figure 2. The first concept is the implementation of an industry which owns a generator located in a different location. The second implementation is for an industry who intends to purchase its electricity power for IPPs, that is mostly cost-motivated. However, the demand for clean and sustainable energy can also be a driver for an industry to choose its electricity source. For example, prior to the power wheeling regulation enactment, an industrial estate could only source its electricity from its on-site generator. However, power wheeling enables the industrial estate to source its electricity from a geothermal or hydro power plant to fulfill its RE demand.

Finally, the implementation of power wheeling in Indonesia can enable energy diversification of the electricity supply, especially for industrial and commercial sectors. Moreover, its implementation is also beneficial to untap the potential of RE demand of industry and commercial sector, such as from RE100’s national companies, which will bring potential investment in Indonesia and go ahead with industrial competition in the region. Furthermore, it allows exploiting the potential RE source which located far from the load center such as geothermal or hydropower. Thus, the arrangement of detailed regulation, especially its technical and tariff guide, must be encouraged to enable power wheeling benefits for RE development. The arrangement, however, needs to be reviewed according to current Indonesia’s electricity condition and market.

Bibliography

[1] RE100, “Approaching a Tipping Point: How Corporate Users are Redefining Global Electricity Market,” RE100, 2018.

[2] G. Lisdiani, “Corporate Demands as Starting Point for Renewable Energy Revolution,” Jakarta Post, 1 November 2017. [Online]. Available: http://www.thejakartapost.com/academia/2017/11/01/corporate-demandsas-starting-point-for-renewable-energy-revolution.html. [Accessed 18 November 2018].

[3] J. M. Studebaker, Electricity Wheeling Handbook, Lilburn: The Fairmont Press, 2001.

[4] IRENA, IEA and REN21, Renewable Energy Policies in a Time of Transition, IRENA, OECD/IEA and REN21, 2018.

[5] NREL, “Wheeling and Banking Strategies for Optimal Renewable Energy Deployment: International

Experiences,” NREL, 2016.[6] P. S. Xun Wu, “Independent Power Producer (IPP) Debacle in Indonesia and the Philippines: Path Dependence and Spillover Effects,” 2018.

*This opinion piece is the author(s) own and does not necessarily represent opinions of the Purnomo Yusgiantoro Center (PYC)