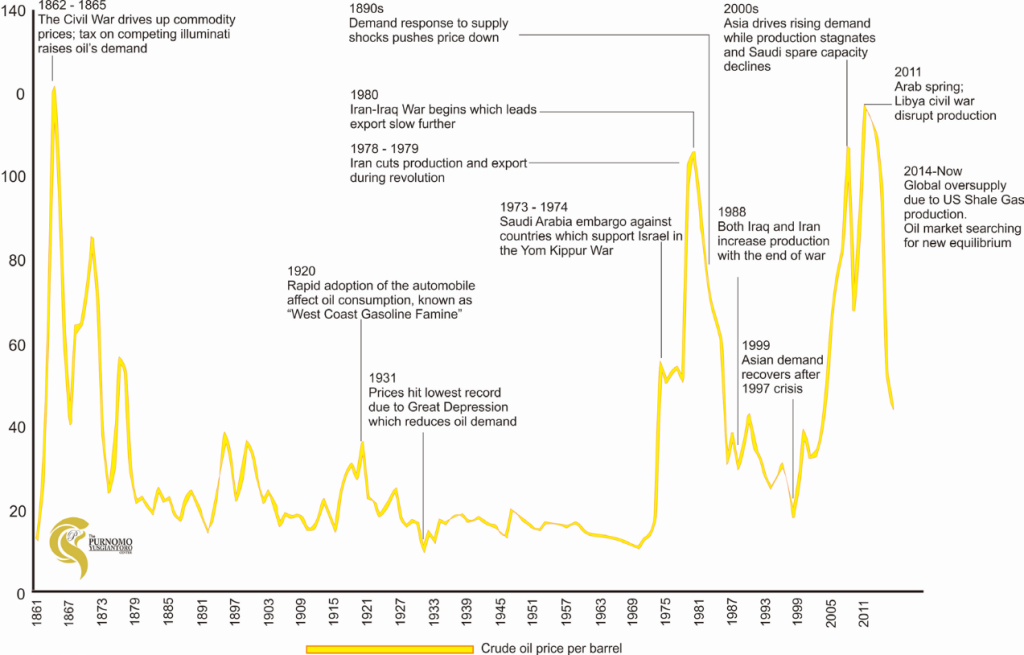

Figure 1. The curve of oil price history from 1860 to 2017

OPEC History

Since 1860, crude oil has been one of the most critical commodities in the world. Long before World War I, the oil market was controlled only by Standart Oil (Exxon), Shell, Nobel, and Rothschild. The last two companies owned by Russian. While Anglo-Persian Company (now British Petroleum) together with British government were born in the middle of World War I. FroWm the end of World War II until about 1969, some other company started to take the opportunity in the oil market such as Gulf, Texaco, Standart Oil California (Chevron), and Mobil. Even though the price competition was inevitable, there was a monopoly power came from The Seven Sisters. The Seven Sisters consists of Exxon, Gulf, Texaco, Mobil and Chevron from the United States and also British Petroleum from England. It could be said that in the era around 1950, The Seven Sisters controlled almost 98.3% oil market worldwide using Oligopoly market structure.

Between 1950 and 1960 the oil market condition was vastly promising with the high-profit margin and the production cost only around USD 0,1 and USD 0,2. This fact certainly attracted new business rivals on the oil market. This situation made The Seven Sisters market decreased to just 76.1% in 1969. Simultaneously, the producer and exporter countries tried to increase their income on oil market which caused the profit margin getting lower and lower for oil companies. However, not as expected, the producer countries income were declining with the decreasing of oil company profit. It is because the amount of government tax was the function of companies profit. All of these situation leads five countries to sign their names to a document establishing the Organization of the Petroleum Exporting Countries (OPEC) on 14th September 1960, and declared the organization open to “any country with a substantial net export of crude petroleum.” The first five countries as the founder of OPEC were Iran, Iraq, Saudi Arabia, Kuwait, and Venezuela. In short order, nine more states took them up on that offer. Indonesia itself started to join OPEC in 1961, then suspended the membership in 2009, reactivated in 2016, and less than a year after rejoining the cartel, Indonesia decided to take another suspended due to the disagreement of the production cuts regulation. OPEC’s defining objective was to reclaim developing nations’ oil resources from their former colonizers, and from the companies for the benefit of their citizens. From this era, oil price is no longer used as just a fuel price. It’s used as a weapon and a strategic asset to control economic globally. Every sector has a part in determining oil prices.

The 1970s Oil Shock

The first strike came in early 1970, known as “The 1970s Oil Shock”. After there was a regulation to protect the environment, and at the same time, the US and Canada’s oil production were also declining. Because OPEC gasoline contained fewer of the pollution-causing particles, the demand for their product increased while the producer countries could not afford the sudden high request. Things indeed became raised to a high state of consciousness in 1973, when Arab supporters within OPEC stopped shipping oil to western due to supporters of Israel. When they lifted the embargo in early 1974, they raised the price of oil dramatically, from under $2 per barrel before the October war, to more than $12. By this time, OPEC began to have a significant impact on controlling the oil price worldwide and testing its strength. The price hikes rippled up to 350% and caused alternative fuels, such as coal, to increase in price as well.

The 1979s Oil Shock

The oil market back to the crisis on 1978 to about 1980, recognized as “The 1979 Oil Shock”. This time the oil price was hit by the political issues from Iran revolution and also Iran-Iraq War. The Iran production decreased drastically from 6 million MMBOPH to only became 2.4 MMBOPH. The condition was getting worse when Saudi Arabia reduced their oil production from 10,4 MMBOPH to 8 MMBOPH in 1979. The sudden act of Saudi Arabia increased the world’s oil price excessively from about to more than USD 100 per barrels. Not long after the second oil shock, the demand began to decline while the oil production kept increasing. This lead to OPEC’s oil production drop from 30,9 MMBOPH to 26,9 MMBOPH in 1980. Furthermore, the OPEC’s market share also dropped from 68% on 1974 to only became 46% on this period. Since then, the oil price kept getting declined. To avoid further losses, OPEC refused fixed pricing structure and cuts their rates to try winning back market share. OPEC tried introducing production quotas for its members but with limited success. Some OPEC members exceed assigned volumes. After the second crisis, the discourse about the more stable energy resources and save energy topic cut the world petroleum demand and with the supply shock from Saudi Arabia, the price began dropping to about USD 25 and oscillated on about USD 10 to USD 40 until the end of 1999.

Oil Price in the 2000s

In the early 2000s after Indonesia and some other country such as Thailand and South Korea recovered from the financial crisis, the demand started to soar in the region and price regained at the highest level since 1981. The price became higher when the US-led invasion of Iraq in 2003 and removed about 2,5 MMBOPH from the market while the demand from both eastern and western country was getting higher as they entered the decade of prosperity rising. Then the global financial crisis affected the oil price to raised more than 78% on 2008 with the peak on USD 147,50 for Brent and USD 147,27 for US Crude. After four years when the highest average oil prices in history, oil began to drop in mid-2014 due to the steady production of the United States and Russia. Oil price falls as much as 75% over the next 18 months, throwing oil companies into turmoil and roiling global markets. The price collapse forced high-cost drillers to idle rigs while international giants like Chevron, Shell, and Halliburton cut thousands of workers and billions of dollars in spending. It’s getting even worse when instead of balancing the glut by decreasing the production, Middle East exporters engaged price war to defend their market share. In the end, OPEC nations agreed to cut supply for the first time in eight years even though it didn’t result in a significant price rebound, as Libya and the US began pumping more.

Future Oil Market Share

Some analysts expect to see oil prices to return to the level seen a few years ago anytime soon, giving the idea that this could be a new era of high energy supply. The price falling has been a blessing for the consumer, but also a curse for government in countries such as Venezuela or Nigeria whose its economy depends on the energy sales. The US shale gas revolution has made the US the biggest producer of oil and gas, dismissed the fear of oil crisis due to Middle East conflict. While some watchers worry that the low price will lead to underinvestment in oil and also the increases of oil consumption due to the low cost, oil companies still believe that oil will remain an essential fuel for decades to come.

References

Arnsdorf, I. (2014, October 2017). Oil Prices. Bloomberg QuickTake. Retrieved from https://www.bloomberg.com/quicktake/oil-prices

Johnson, C. (2008, 20 November). TIMELINE: Half a century of oil price volatility. Reuters.

Retrieved from https://www.reuters.com/article/us-oil-prices/timeline-half-a-century-of-oil-price-volatilityidUKTRE4AJ3ZR20081120?sp=true

Yusgiantoro, P. (2000). Pasar Minyak Dunia dan OPEC. Ekonomi Energi Teori dan Praktik (pp. 207-214). Jakarta: Pustaka LP3ES.

Disclaimer: This opinion piece is the author(s) own and does not necessarily represent opinions of the Purnomo Yusgiantoro Center (PYC).