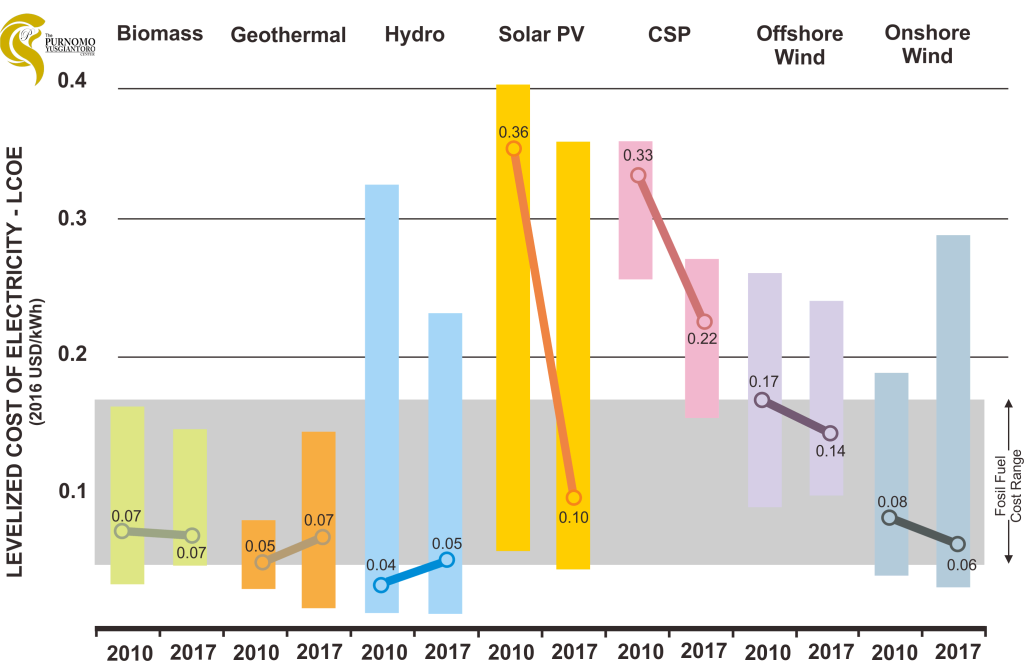

The judgment of renewable energy which always related to its high and uncompetitive price compared to fossil fuel might be ended up very soon. Report from the International Renewable Energy Agency (IRENA) in 2017 has shown that there was an impressive cost reduction of renewable energy worldwide. The cost reduction especially occurred in the Solar and Wind Power as seen in Figure 1. It shows the price difference between 2010 and 2017 for seven types of renewable energy globally.

Figure 1. Levelized Cost of Electricity of Renewable Energy in 2010 and 2017 (Source: Processed IRENA, 2017)

The average price of Solar Photovoltaic (PV) power plant in 2010 was USD 0.36 /kWh, while seven years later, it decreases to only USD 0.10/kWh on average or about 72 percent price reduction. The remarkable costs make renewable energy become one of the most competitive sources of the power generator. The cost decreases are mainly caused by two factors:

- First, is the vast improvement of technology worldwide. Technology is one of the essential aspects in term of improving performance and reducing the cost. The trajectory of energy prices is not only occurred in renewable energy but also in the fossil The emerging of new technology is always associated with the high price, but the consistent improvement of technology and good policies support will reduce the price eventually. In renewable energy, as stated above are clearly shown in solar and wind technology. Today, solar technology can be divided into two categories, the solar PV technology and Concentrating Solar Power (CSP). China is surpassing the European Solar PV market with both producing large scale of Solar PV and installing 88 GW of Solar PV in just 2 years between 2014 and 2016 alone. The technology improvement has brought crystalline silicone module to improve its efficiency from 12 percent to 17 percent or more outside the laboratory. The module technology is continued to improve worldwide which lead to a more competitive market. The competitive market will allow users to meet their module preference based on their needs and budget. In the last seven years, the Solar PV module price itself has decreased around 83 percent in Europe. Have a different method in generating energy than Solar PV, CSP works as mirrors which create high-temperature heat to activate the steam turbine. In CSP, technology improvement mostly occurred in the collectors and mirrors which have successfully reduce the capital cost of CSP. Aside from the solar-based energy power generator, wind power also experience the significant cost decreases due to the technology improvement. Although the wind power cost is driven by the price fluctuation of its materials such as steel, copper, and cement, the average installation cost is declined globally. The cost reduction especially begins when the industry started to install new and more efficient wind turbines and create higher capacity factors and cheaper cost. Since wind turbines represent the biggest share, ranging from 30 to 84 percent of total cost, the cost reduction of wind turbine is profoundly affected by the cost installation of wind power.

- Second is the more competitive market of renewable energy. Despite the significant effect of technology in renewable energy’s cost reduction, the competitive market also considers as another essential factor which drives the decreases of renewable energy price globally. Renewable energy companies are no longer restricted in just specific region; they are already broadening their business throughout the world. Today, renewable energy is no longer categorized as the new form of energy, on the other hand, the renewable energy market has become more mature, new companies started to emerge, and it crowds the procurement process. The intense competition has pushed the company to adopt the newest technology and implementing the best practices while reducing the margins. For example, hydropower as the earliest version of renewable energy and dominated the renewable energy capacity has been modified to adjust the markets well. Even though hydropower is known for its attractive price compared to other renewable energy, it is still considered as a capital intensive Unlike the solar and wind-based technology, the biggest component in the installation cost of hydropower comes from the labors and infrastructure development costs. A large number of the capital cost to build dam, tunnels, canal, and the powerhouse should be spent by the company before they can generate the profit. In some cases, pre-feasibility studies and feasibility studies should be conducted first before the project begin to make sure the safety of the project, especially in a densely populated area. In addition to the capital-intensive, many large hydropower projects face the acceptability issues from the local residences. Thus, companies should be able to construct hydropower in various size and properties. Another excellent example of the competitive renewable market can be found the geothermal power. Geothermal power plant performance is highly affected by its quality of resources as well as its field management. It is highly important to know how to manage the geothermal field well so that the resources can be used optimally. Hence, the experiences are one of the biggest consideration in choosing the geothermal company since such specific knowledge cannot be quickly learned.

As one of the countries which signed and ratified the Paris Climate Agreement, Indonesia is obligated to reduce the greenhouse gases emission. One of the list in the emission reduction program is to decrease the dependency on the coal power plant to a more environmentally friendly power plant such as renewable energy. Indonesia is one of the biggest coal producer countries in the world; it is used not only as the export commodity but also as the primary source of power generation. To this day, the conventional coal power plant is still dominating about 60.5 percent of the national power plant, while renewable energy only occurs about 12.4 percent (ESDM, 2019). Despite the government target to increase the renewable energy share to be 23 percent within the national energy mix by 2025, the significant decreases of renewable energy investment happened last year in 2018. There were only 4 renewable energy contracts signed in 2018, a highly significant decrease if we compare it with 70 contracts signed in 2017. Many believe that it was caused by the implementation of MEMR Regulation 50/2017 on renewable energy. MEMR Regulation 50/2017 is formerly revoked the previous regulations, MEMR Regulations 12/2017 and 43/2017. Two significant factors obstruct the renewable energy investment based on the current regulation, first is the tariff framework which utilizes the regional electricity generation base cost (Biaya Pokok Penyediaan Pembangkitan, “BPP” daerah) as the reference and the capping price of the renewable energy tariff. Second is the obligation for Independent Power Producer (IPP) to use Build, Own, Operate, Transfer (BOOT) scheme in the Power Purchase Agreement (PPA) contract.

As mentioned before, most of Indonesia’s power generators are using conventional coal as the power source. The coal power plant is the cheapest power plant compared to another power plant. Another advantage of coal is that it is still considered as abundant natural resources in Indonesia, easy to be distributed and can be used as the based load of electricity. It is not an easy task for the renewable energy market to compete with such Indonesia’s coal power plant market. The domination of the coal power plant has dropped the electricity generation base cost (BPP), especially in Java Island. Although the BPP tariffs in some least developed areas are still considered high, the electricity demands are low or even consider as an off-grid zone. Investors will not be interested in building renewable energy power plant if their calculation is yet reached their desired margin. Alternatively, the government can run renewable energy projects themselves through PT PLN or so-called on the government balance sheet. However, this is almost impossible since the government budget is limited. Hence, it is essential to attract the investor to take part in developing renewable energy. In term of deciding the tariff framework, there are some options that the government could apply:

- Increasing the percentage of renewable energy tariff compared to regional BPP. Today the maximum tariff for Solar PV, Wind, Hydro and Biomass have pegged 85 percent of regional or national BPP, while Municipal Waste and Geothermal take higher tariff or maximum 100 percent of regional or national BPP.

- Rather than using BPP as the tariff reference, the Feed-in Tariff (FiT) could be applied based on various type of projects such as based on technology, fuel type, project size, resource quality, and The full review of FiT implementation has been written in the previous articles, titled “Brief Notes for Indonesia’s Feed-in Tariff (FIT) Implementation”(Cindy, 2018). However, with the vast technology advancement and price decreases as mentioned in the earliest paragraph, the government should regularly adjust the reference tariff.

- The last option is to implement the auction based approach as the policy to develop renewable The auction will allow the company to propose their cheapest cost, while still covering the desired margin, so it can be said that the real price will be revealed. The auction will also allow the government to decide which price still guarantee the quality of work and ensure the stability of the long-term projects.

In the author point of view, the auction can be the best option to be applied in Indonesia to cope with the rapid price decreases of renewable energy. Project developer will adjust their bids to the lowest based on the requirement while still manage to generate a decent profit. However, there are some risks associated with auction such as the underbidding. Underbidding will affect not only the project developer but also government as the project owner. The destructive bidding will cause project developer to the unsustainable finance and even lead to the bankruptcies, while for the government it will cause lagging development.

Bibliography

Cindy, M. A. (2018). Brief Notes for Indonesia’s Feed-in Tariff (FIT) Implementation. Retrieved from Research Opinion PYC: https://purnomoyusgiantorocenter.org/

ESDM. (2019). Equitable Energy: 4 Year Achievements, up to 2018. Jakarta: ESDM.

IRENA. (2017). Renewable Power Generation Costs in 2017. Abu Dhabi: IRENA.

Disclaimer: This opinion piece is the author(s) own and does not necessarily represent opinions of the Purnomo Yusgiantoro Center (PYC).