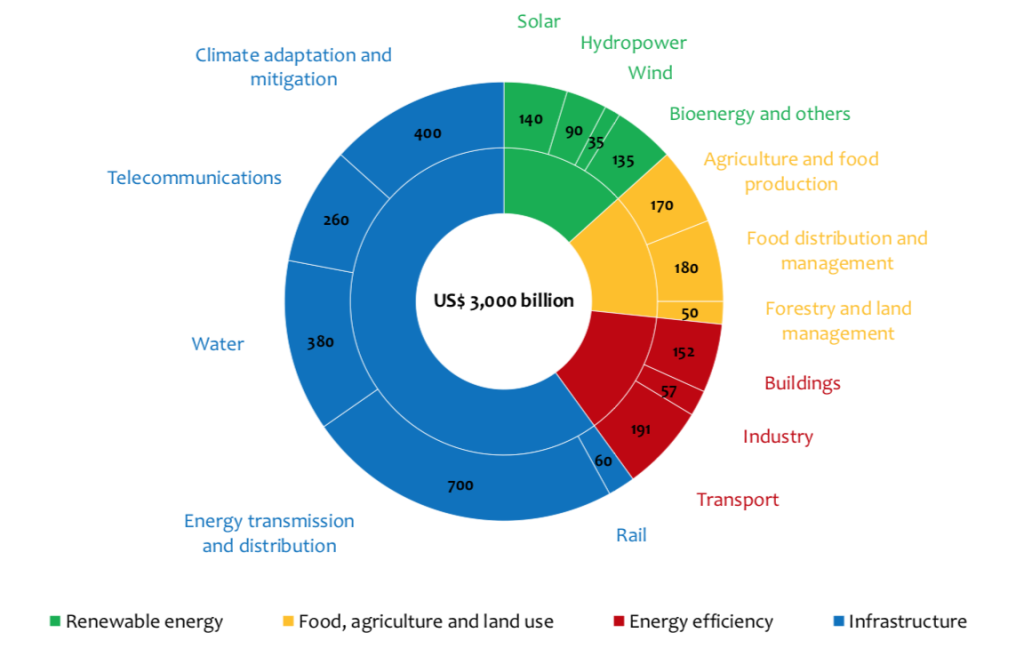

The Paris Agreement and UN’s Sustainable Development Goals address an important objective to mobilize investment to meet the goal of limiting global warming to, at most, 2 degrees Celcius. As stated by the International Finance Corporation (IFC) Investment Opportunities report in 2016, the target from the Paris Agreement could create US$23 trillion in investment opportunities for 21 emerging-market countries.[1] Half of these countries are from East Asia and Pacific regions, which represent 62% of the world’s population, and hold 48% of global Green House Gas (GHG) emissions (Figure 1). These investments, or mostly called “green” investments, are invested opportunities into climate-related projects, with majority to green buildings, and small portions to sustainable transports and renewable energy. Meanwhile, the rest of the projects can be invested into electrical transmission and distribution, industrial energy efficiency and waste.

Figure 1. Investment Potential 2016-2030 (US$ billion)

(Source: IFC Investment Opportunities Report, 2016)

In Indonesia, the government has pledged 29% reduction in GHG emissions by 2030 under the Paris Agreement. This is an important step for Indonesia given that Indonesia is ranked the 6th biggest producer of GHG emissions. Following the country’s pledge, Indonesia has launched a Sustainable Finance Roadmap for the Period 2015-2019 through the Indonesia’s Financial Services Authority (OJK). The Roadmap involves the formal financial sector (banking, capital market and non-bank financial institutions) to contribute to the national commitment to address climate change and support the transition to a competitive low carbon economy. Technically, this means that OJK requires banks to develop action plans for sustainable financing and report their green financing.

There are other “green” policies and bonds issuances from the Indonesia’s government besides The Roadmap. Indonesia issued Requirements for Green Bonds on December 2017. These requirements are aligned with the international standards on Green Bonds Principles (GBP) and ASEAN Green Bond Standards, covering the definition of sustainable finance, principles of sustainable finance and Action Plan for banking, capital markets and non-banking sectors. On February 2018, Indonesia issued the first sovereign green sukuk (Islamic green bond) by the government of Indonesia for US$1.25 billion to fund a number of environmentally friendly projects such as renewable energy, green tourism, and waste management projects. Through this first green sukuk, Indonesia then is known to be the first Asian country to issue a sovereign dollar-denominated green bond. In the same month, the first Asian corporate sustainability bond of US$95 million was also issued by Indonesia through The Tropical Landscapes Finance Facility (TLFF) for sustainable rubber plantations in two provinces in Indonesia. On April 2018, a US$580 million of green bond is offered to finance a geothermal energy from Star Energy.

There were also two more bonds issued. The first is PT SMI (a state-owned non-bank financial institutions) issuing a green bond with the support from the World Bank for IDR 3 trillion (US$200 million) with a maximum emission value of IDR 1 trillion (US$60 million) in the first phase of 2018. The second one is The International Finance Corporation (IFC) investing US$150 million in the first ever green bond issued by a commercial bank in Indonesia. This five-year green bond was issued by PT Bank OCBC NISP and will be used by the bank to finance climate related projects.

On May 2018, eight national banks representing 46% of Indonesia’s banking assets announced the formation of the Indonesian Sustainable Finance Initiative (IKBI).[2] The formation of IKBI is a concrete manifestation of Indonesia’s banking commitment in implementing inclusive financial practices that are inclusive in the financial services sector. This platform is open to the financial services industry of banks and non-banks, issuers, and other relevant industrial sectors. While recently on January 2019, Indonesia issued again a second green sukuk following its successful first green sukuk a year earlier.

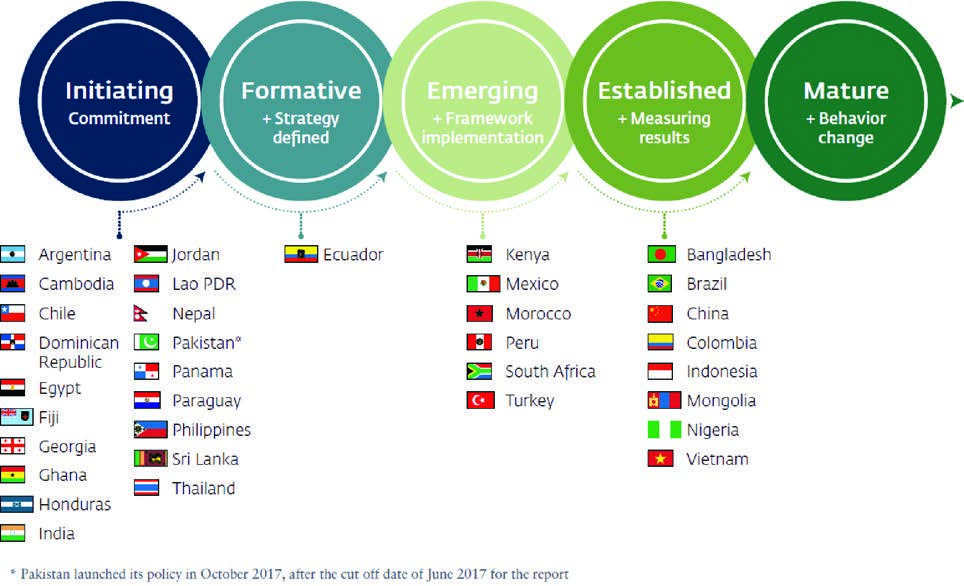

Through Indonesia’s “green” commitment and initiatives in the past few years, IFC sees Indonesia’s sustainable finance as in its “Established” stage (see Figure 2). This specifically means that the country has comprehensive implementation actions in place and has begun to report on results and impacts of their commitment on sustainable finance.

Figure 2. IFC Assessment of the Sustainable Banking Network (SBN) Countries’ Progress in Sustainable Finance (Source: SBN Global Progress Report, IFC, 2018)

Indeed, the progress of green finance should have a significant impact to the energy sector, especially in the renewable energy sector. As shown in Figure 3, 13.34% green finance opportunities reach the ASEAN renewable energy sector, such as solar, hydropower, wind and bioenergy and others. As for Indonesia, these green finance opportunities are large, as stated in the report of United Nations Environment Programme and DBS in 2017. It is identified that Indonesia is likely able to absorb at least around US$8 trillion, or around 36% of total potential investment, in infrastructure and renewable energy sectors. Nevertheless, the utilization of green financing opportunities for renewable energy in Indonesia has not been maximised.

Figure 3. Sectoral Breakdown for ASEAN Green Finance (in US$ billion)

There are two main problems that could be identified. The first problem is on the perspectives of financial institutions on renewable energy. Most financial institutions do not see the urgency to build capacity to assess the risks of renewables although OJK has put forward a bold strategy on its roadmap. Most large financial institutions in Indonesia are still unfamiliar with renewable projects; hence they still considered renewables small in the country. In particular from local commercial banks, they perceive renewable energy projects as being too risky. Therefore, majority of commercial banks remained in conventional business models because of the very high profit margins attained. The second problem is that there are unattractive renewables financing scheme to attract private investors. Most financing scheme has not addressed clearly on the challenge of long-term projects. For example, most of the energy projects last to about 20 years, while commercial bank tends to cap the loan tenor to about 8 years. This makes investments in renewable energy difficult to manage, either on servcing the loans as well as meeting the operation and maintenance costs.

To resolve those problems, there are some solutions that can be offered. The first one is the need to create more financial instruments for long-term green investment. For example, green bonds or sukuk (Islamic bonds). Insurance companies might also help by lending directly to green projects with longer-term investment needs. These companies could increase financial system effectiveness by purchasing green assets channelled by banks into capital markets. This could be achieved by transforming assets such as green bank loans into liquid, tradeable and rated securities such as asset backed securities or investment trusts. The second solution is for government to provide a more specific list of projects through green finance. This is to make the market clear that once a green bond issued, there are no penalties of companies breaking their green promises. Without clarity on the list of projects, there will be difficulties to allocate capital towards green projects and assets. Another alternative solution is related to energy companies given that there are insufficient environmental disclosures from companies and limited information-sharing platforms. This makes it more difficult for financial decision makers, such as commercial banks, to identify, price and manage environmental risk. It also creates challenges in identifying new opportunities, and for companies trying to attract new sources of green funding.

Bibliography

Sustainable Banking Network (SBN) Global Progress Report (February 2018). Retrieved from The International Finance Corporation (IFC) Website: https://www.ifc.org/wps/wcm/connect/71e6f2f5-8fb5-40a1-bc17-e04a85037980/SBN-GlobalProgressReport.pdf?MOD=AJPERES

Green Finance Opportunities in ASEAN (November 2017). United Nations Environment Programme and DBS. Retrieved from the DBS website: https://www.dbs.com/iwov-resources/images/sustainability/img/Green_Finance_Opportunities_in_ASEAN.pdf

Roadmap Keuangan Berkelanjutan di Indonesia (Roadmap for Sustainable Finance in Indonesia) 2015-2019 (December 2014). Retrieved from OJK website: https://www.ojk.go.id/id/berita-dan-kegiatan/publikasi/Documents/Pages/Roadmap-Keuangan-Berkelanjutan-2015-2019-di-Indonesia/roadmap-keuangan-berkelanjutan-2015-2019-di-indonesia.pdf

Cilmate Investment Opportunities in Emerging Markets-An IFC Analysis (2016). Retrieved from the International Finance Corporation (IFC) Website: https://www.ifc.org/wps/wcm/connect/51183b2d-c82e-443e-bb9b-68d9572dd48d/3503-IFC-Climate_Investment_Opportunity-Report-Dec-FINAL.pdf?MOD=AJPERES

[1] The 21 emerging market countries are Brazil, Chile, China, Colombia, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Romania, Russia, Singapore, South Africa, Taiwan, Thailand, and Turkey.

[2] The eight banks are Bank Artha Graha Indonesia, BRI Syariah, Bank Central Asia, Bank Mandiri, Bank Muamalat, Bank Negara Indonesia, West Java and Banten Regional Development Banks, and Bank Rakyat Indonesia. They belong to the group ‘First Movers on Sustainable Banking’.

Disclaimer: This opinion piece is the author(s) own and does not necessarily represent opinions of the Purnomo Yusgiantoro Center (PYC).