Historically, coal can be considered as a source of energy which catalyzed the first industrial revolution. The development of the steam machine was an important aspect of the industrial revolution which allowed the transition of hand production methods to machine powered production. The use of steam-powered machinery for transportation and industrial use drove the global coal demand in the 19th century. With the growing demand for coal in Europe, the coal mining industry flourished, and coal production increased.

For more than a century, coal acted as one of the most important sources of energy, especially for developing countries. Coal provides a relatively cheap source of energy and is easy to be transported. However, with the growing environmental concern, many countries started phasing out coal consumption to a much cleaner source of energy which will cause concerns for the coal exporting country. Evidently, the International Energy Agency (IEA) observed a stagnating demand for coal in the global market related to the shifting to clean energy.

With the abundant coal reserve and production, Indonesia is able to export coal as commodities. Additionally, the government also shows that coal will still play an important role in fulfilling energy demand in Indonesia. In this regard, Indonesia will face challenges as a global market player as well as a consumer of coal. This column aims to see Indonesia’s position in the global coal market, the role of coal as a source of national income and electricity generation, as well as the future of coal utilization in Indonesia.

Indonesia in the Global Coal Market

International Energy Agency (IEA), in its IEA Coal Report 2017, highlighted the growth of coal demand from 1999 to 2017 which reached up to 4.5 percent per year as presented in Figure 1. The growing demand for coal during this period was led by the high coal consumption in China and India as both countries accelerated their economic growth through industrialization. With the high industrialization, both countries required a significant amount of electricity to power the industry and coal were considered as the cheapest source of energy to generate electricity. From 2012 the demand for coal relatively stagnated over the years. IEA expected that stagnating coal demand over the years was caused by the shifting of demand to a relatively cleaner source of energy. However, IEA still expects coal demand to be on the same level at least until 2022. Although India and China are currently shifting to green energy, they are still expected to lead the demand for coal.

Figure 1. Global coal demand data (1999 – 2016) and prediction (2017 – 2022) (International Energy Agency, 2017b).

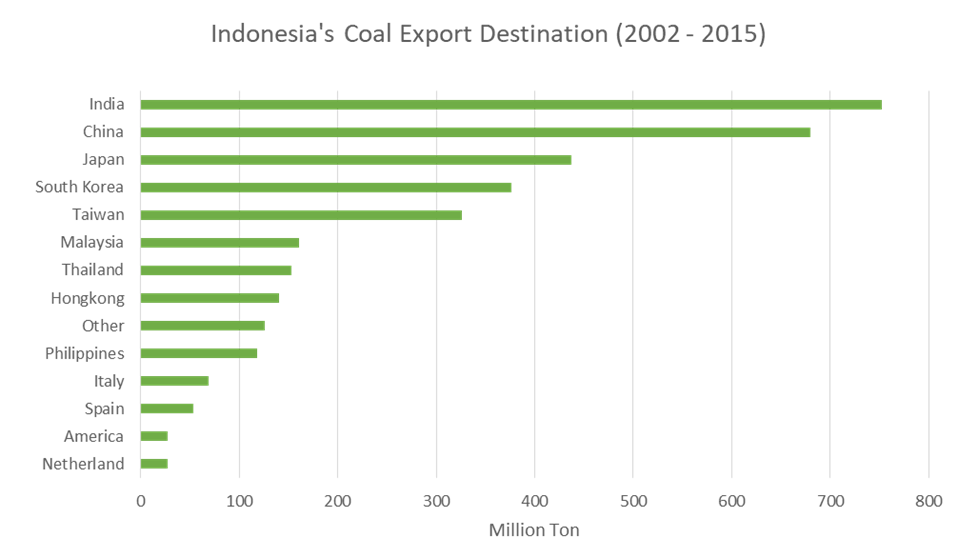

Indonesia is one of the world’s largest coal producers behind China, India, America, and Australia. Despite their large coal production, China and India are also the two largest coal importer with a combined import value reaching up to 447 Million ton in 2016. On the other hand, the demand for coal in Indonesia and Australia were still lower than their respective production, and thus they managed to fulfill their domestic demand. With excess coal production, Indonesia became the second largest coal exporter, just behind Australia (International Energy Agency, 2017a). Figure 2 shows that India and China are the largest destinations for Indonesia’s coal export with a cumulative value of over 1,432.22 Million ton between 2002 and 2015. This figure shows that Indonesia’s coal market highly depends on the coal policy of China and India. While IEA’s prediction still shows a huge demand of coal coming from China and India, the advancement of relatively cleaner sources of energy will affect the demand for coal from both countries, thus affecting Indonesia’s coal market.

Figure 2. Indonesia’s cumulative coal export destination by country between 2002 and 2015 (Badan Pusat Statistik Indonesia, 2018).

Figure 2. Indonesia’s cumulative coal export destination by country between 2002 and 2015 (Badan Pusat Statistik Indonesia, 2018).

Coal as Source of National Income

Indonesia is blessed with an extensive amount of coal reserves with 90 percent of the reserves being low and medium rank coal (Kementerian Energi dan Sumberdaya Mineral, 2018). The largest low-rank coal reserve in Indonesia is located in South Sumatera, followed by East Kalimantan. Additionally, East Kalimantan also has the largest medium rank coal reserve with the largest high-rank coal reserve located in Central Kalimantan. With the abundant reserve of coal and current production rate, Indonesia will be able to continue as one of the major global coal exporters. The Ministry of Energy and Mineral Resources reported that in 2017 the majority of coal production in Indonesia (up to 65 percent) was exported. The remaining 35 percent was then mostly used as fuel for the steam power plant, and only a small portion was used by the industry and transformed into coal briquettes. This shows that coal utilization in Indonesia is still limited to power generation and yet to focus on the processing of coal into higher value products such as Dimethyl Ether (DME).

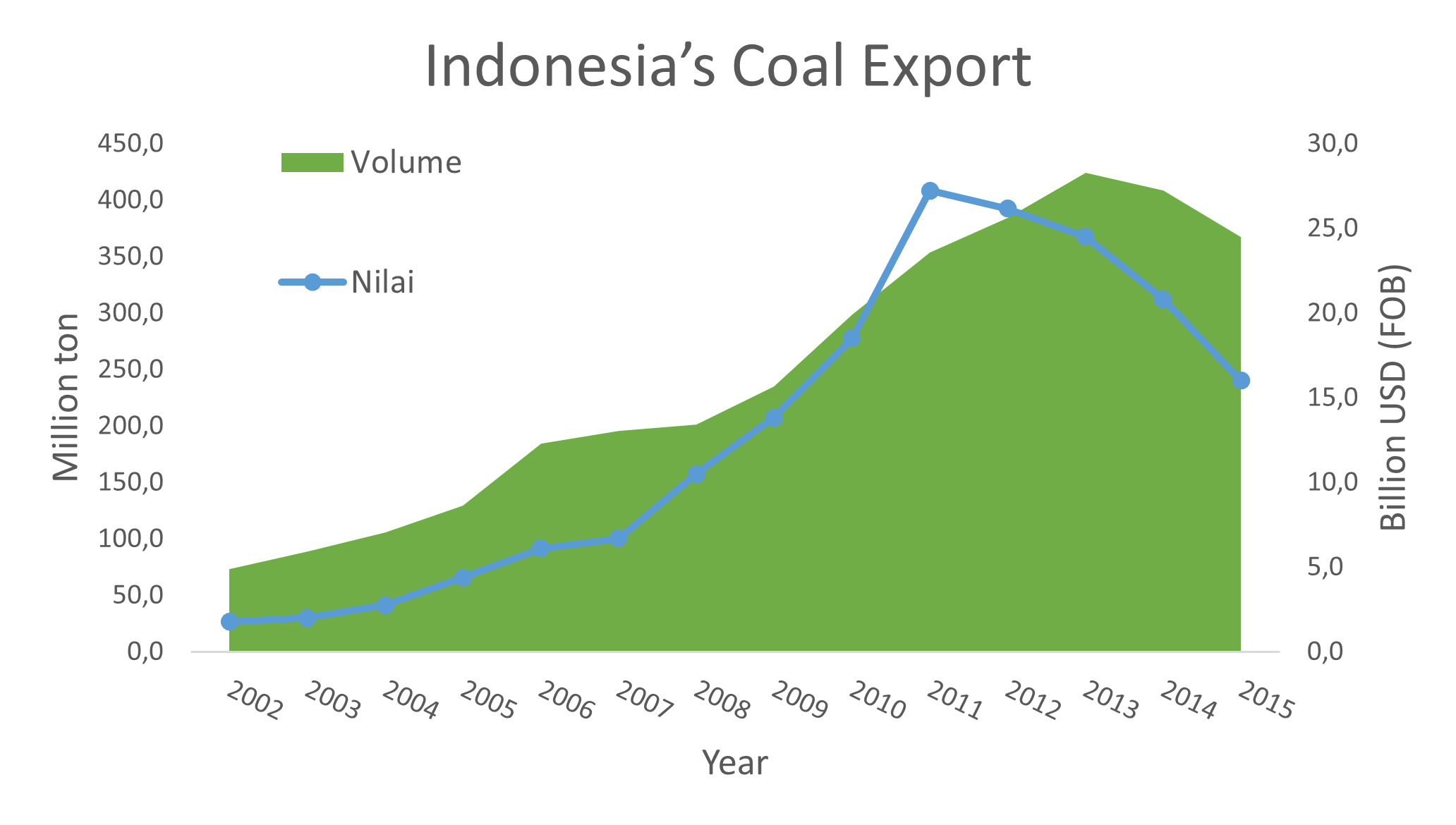

Figure 3 shows Indonesia’s coal export volume and value. Indonesia’s coal export volume underwent a significant increase between 2002 and 2013, raising from 73.1 million ton in 2002 to 424.3 million ton in 2011. While showing a similar trend, the coal export value peaked in 2011, earlier than the peak export volume in 2013. The different peak was caused by the coal price which exceeds USD 120 per ton in 2011. With the high coal price in 2011, coal producers in Indonesia ramped up their production which resulted in the peak production in 2013. However, in 2013, the global coal price dropped under USD 100 per ton which lead to the decrease of both the export volume and value in the following years until 2015.

Figure 3. Indonesia’s coal export volume and value (Badan Pusat Statistik Indonesia, 2018).

Figure 3. Indonesia’s coal export volume and value (Badan Pusat Statistik Indonesia, 2018).

Coal and Electricity Generation in Indonesia

Through Government Regulation No. 79/2014 (PP No. 79/2014) on the General Planning for National Energy (Rencana Umum Energi Nasional, RUEN), Indonesia’s government plan to reduce the portion of coal in the national energy mix to only 30 percent in 2025. However, coal will still play a huge role in fulfilling the national energy mix and will still account up to 25 percent in 2050 which could reach 439 million ton. The Ministry of Energy and Mineral Resources report indicated that in 2018 most of coal consumption in Indonesia was still limited to power generation with only small portion of the primary coal supply used in the industry (Kementerian Energi dan Sumberdaya Mineral, 2018).

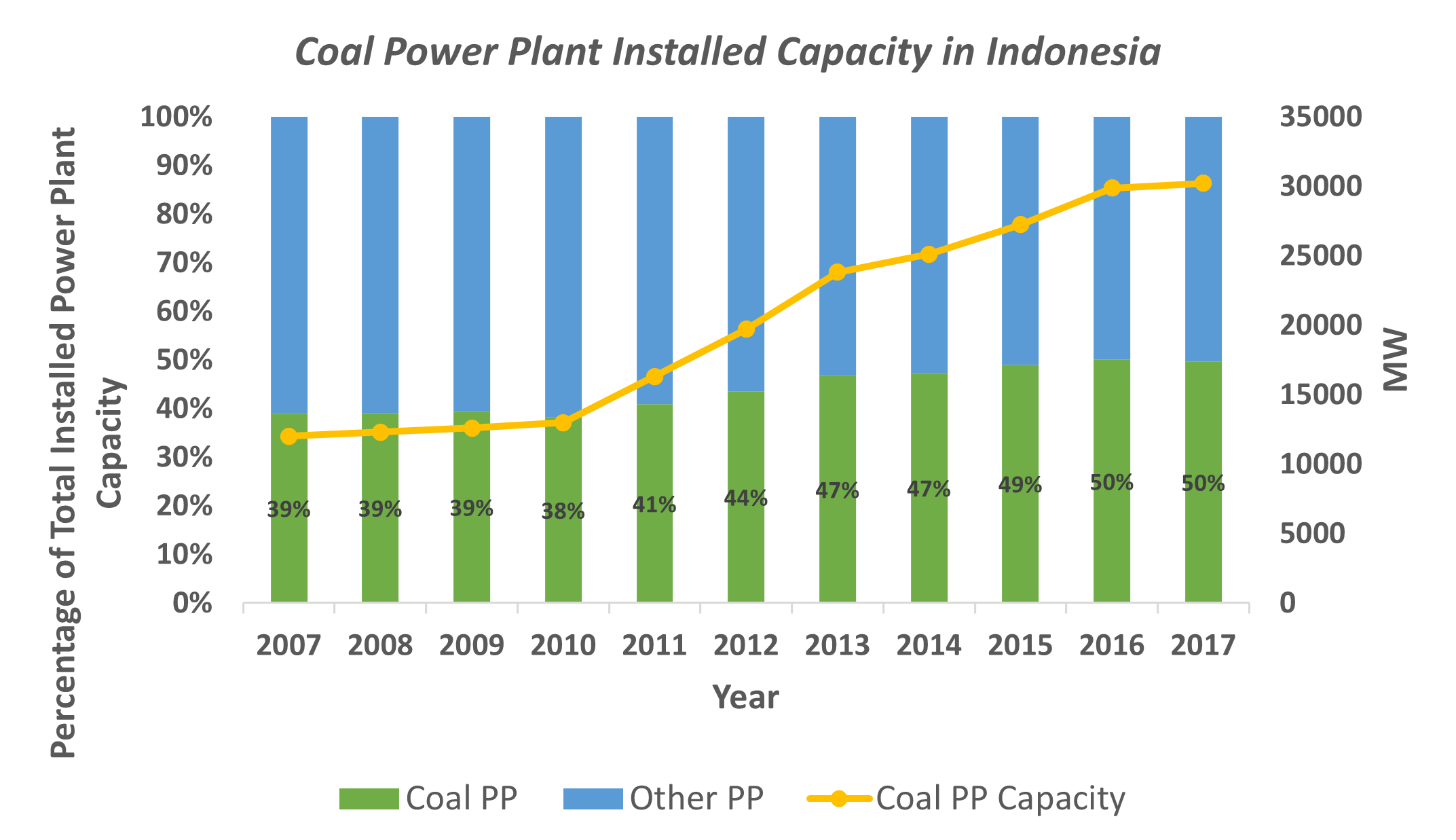

Steam Power Plant fueled by coal had been the dominant source of power generation in Indonesia, and despite the government’s commitment to utilize a cleaner source of energy, the installed capacity of coal power plants have always been on the rise. Figure 4 shows the installed coal power plant capacity and its share compared to other power plants from 2007 to 2017. The capacity of coal power plants from 2007 until 2010 stayed relatively on the same level. However, in 2011, the capacity of coal power plants started increasing significantly until 2017. Accordingly, the share of coal power plants in the electricity generation mix in Indonesia rose to 50 percent in 2017 from 39 percent in 2007.

Figure 4. Comparison between the installed capacity of coal power plants and other power plants in Indonesia (Kementerian Energi dan Sumberdaya Mineral, 2018).

In the Electricity Supply Business Plan (Rencana Umum Penyediaan Tenaga Listrik, RUPTL), PT PLN predicts that coal demand in the electricity sector will increase until 2024 (PT Perusahaan Listrik Negara (Persero), 2019). It is expected that by 2024 Indonesia will need 137 million ton of coal to generate electricity from the steam power plant. By 2025, PT PLN predicted that coal power plant will still dominate the electricity mix with 54.6 percent, higher than the target planned in RUEN (30 percent in 2025). The mismatch happened as the economic aspect is still heavily weighted for electricity generation in Indonesia. Coal power plants, without any environmental incentive and disincentive, still provide the cheapest option compared to renewable energy and gas power plant. This trend is expected to continue unless the government interferes with a strict regulation which aims to reduce carbon emission from electricity generation.

Future of Coal Utilization

As previously discussed, planned or not, coal will still play a major role in Indonesia’s power sector. Currently, coal provides the cheapest source of energy but came with a huge environmental impact. With the demand for clean source energy on the rise regulations on the carbon-intensive source of energy will soon regulate the usage of coal power plants. The utilization of coal as a fuel for electricity generation will definitely produce carbon emission. However, with the current technological advancement, it is possible to reduce carbon emission from the coal power plant through the use of Super-critical (SC) and Ultra Super-critical (USC) coal power plant. Conventional, SC and USC coal power plant differentiate in the temperature and pressure used during the coal combustion. SC and USC coal power plant utilize higher temperature and pressure to reach the critical point of coal, and thus, increases the power plant efficiency. Table 1 shows a comparison between conventional, SC, and USC coal power plant. SC and USC coal power plant claimed to be able to reduce carbon emission up to 30 percent compared to the conventional coal power plant. From this point of view, it is clear that the utilization of SC and USC coal power plant will be an important point for electricity generation in Indonesia who will still rely on coal power plant until 2050.

One major problem in the development is the relatively higher capital investment needed. In its report, IEA indicated that initial investment for SC and USC power plant could reach up to 75 percent than a conventional coal power plant. To address this problem, a disincentive scheme in the form of a carbon tax can be applied. Implementation of a carbon tax to coal power plant can potentially reduce the Levelized Cost of Electricity (LCOE) gap between conventional coal power plant with SC and USC power plant to less than USD 10/MWh (International Energy Agency, 2018). Proper regulation will be able to increase the economics of SC and USC power plant which will push the utilization of clean coal.

Table 1 Comparison between Sub-critical, Super-critical, and Ultra Super-critical coal power plant (Barnes, 2015; Wang, 2014)

| Sub-critical(Conventional) | Super-critical | Ultra Super-critical | |

| Temperature (°C) | 500 – 550 | 500 – 600 | 600 – 700 |

| Pressure (MPa) | 16 – 17 | 24 – 26 | 40 – 42 |

| Efficiency (%) | 33 – 35 | 40 – 45 | 50 – 55 |

| Emission reduction (%) | (Reference) | 13 | 30 |

With the stagnating trend of coal demand in the global coal market and the eventual coal phasing out in Indonesia, a diversification process needs to be done to the domestic coal supply. Currently, most of Indonesia’s coal production ended up as an export commodity without any value added. While coal export also generated a significant amount of national income, this situation created volatility of the income generated relative to the global coal price. Although mainly considered as fuel for steam power plant, coal can also be gasified or liquefied to produce its derivatives such as syngas and DME. The resulting syngas can then be used as feedstock to produce fertilizers while the produced DME can be used for Liquefied Petroleum Gas (LPG) mixing.

Since its cooking fuel transition from kerosene, the demand for LPG in Indonesia kept increasing over the years. Indonesia currently imported more than 50 percent of its domestic LPG supply and by 2025 RUEN expected that there would be 9.5 million ton of LPG demand by 2025 in Indonesia. Utilization of coal gasification to produce DME will play an important role to reduce the import of LPG. In order to support and accelerate coal gasification industry, significant investment and commitment from the government will be needed in the coming year. In this regard, the National Energy Council (Dewan Energy Nasional, DEN), through RUEN, plan to start DME production in 2020 with PT Bukit Asam as the first State Owned Company (Badan Usaha Milik Negara, BUMN) operating the project.

Indonesia’s Coaleidoscope (Coal-Kaleidoscope)

In the coming years, Indonesia will still rely on its coal to generate income as well as for domestic consumption. The significant amount of electricity generated through coal power plant underlined the importance of coal for Indonesia as demand for electricity for households and industry will continue to grow and with the abundant coal reserves, Indonesia has little to worry about domestic coal supply. However, it is also important for Indonesia to start phasing out coal to comply with the global commitment in reducing carbon emissions. Applications of various clean coal technology could help coal power plant to become a more environmentally friendly source of energy. Additionally, the government has to also stimulate the coal processing industry to its derivatives. Production of syngas and DME could help ease the demand of LPG as well as provide feedstocks for fertilizers industry. It is important to create a strong coal roadmap with a strong willingness to manifest the results.

References

Badan Pusat Statistik Indonesia. (2018). Ekspor Batu Bara Menurut Negara Tujuan Utama, 2002-2015. Retrieved March 13, 2019, from https://www.bps.go.id/statictable/2014/09/08/1034/ekspor-batu-bara-menurut-negara-tujuan-utama-2002-2015.html

Barnes, I. (2015). Upgrading the Efficiency of the World’s Coal Fleet to Reduce CO2 Emissions. The Official Journal of World Coal Industry, 3(1), 54–58. Retrieved from https://www.worldcoal.org/file_validate.php?file=Cornerstone_Volume3_Issue1.pdf#page=41

International Energy Agency. (2017a). Key World Energy Statistics. Paris: International Energy Agency.

International Energy Agency. (2017b). Market Series Report: Coal 2017. Paris. https://doi.org/10.1787/coal_mar-2017-en

International Energy Agency. (2018). The Clean Coal Project. Jakarta: International Energy Agency.

Kementerian Energi dan Sumberdaya Mineral. (2018). Handbook of Energy and Economic Statistics of Indonesia. Jakarta: Kementerian Energi dan Sumberdaya Mineral Republik Indonesia. Retrieved from https://www.esdm.go.id/assets/media/content/content-handbook-of-energy-and-economic-statistics-of-indonesia.pdf

PT Perusahaan Listrik Negara (Persero). (2019). DISEMINASI RUPTL 2019-2028 PT PLN ( Persero ).

Wang, J. (2014). Study of Supercritical Coal Fired Power Plant Dynamic Responses and Control for Grid Code Compliance. London.