By: Filda Yusgiantoro, Rahmantara Trichandi, and Anggun Alfina Zakia

Projects with high impact on the Sustainable Development Goals (SDGs) commonly required a significant amount of funding. However, these types of projects rarely come with a high return, hence they could attract only a small amount of investments from investors. Through growing sustainable financing programs, the above mentioned problem could be solved with the Green Bonds mechanism, as it is expected to be the most effective way for the SDGs to be realized.

Issued the first time by the European Investment Bank in 2007, the most successful year yet so far for the Green Bonds mechanism has just started in 2016 and shown a rapid growth until now (see Figure 1). The Climate Bonds Initiative, an international nonprofit organization on mobilizing the largest capital market of all, has highlighted that an approximate amount of USD 250 – 300 billion will be put into Green Bonds finance globally in 2018 (Climate Bonds Initiative, 2018). This figure is almost double the invested global Green Bonds fund in 2017.

Figure 1. Green Bonds Issuance from 2013 – 2020 (Source: Climate Bonds Initiative, 2018)

Specifically in the development of energy sector, there are positive results deriving from the Green Bonds mechanism. As stated in the report of Green Bonds Highlights 2017 by the Climate Bonds Initiatives (2018), the most common use of Green Bonds investments is for renewable energy. As shown in Figure 2, the figure shows an increasing amount of the committed Green Bonds fund from US $87.2 billion (2016) to US $155.5 billion (2017). It can be seen also in the figure that green bonds investments in low carbon buildings and energy efficiency sector grew the most during this period, but investments in renewable energy dominated the share in both years; 38% in 2016 and 33% in 2017. The significant large portion of fund dedicated to the renewable energy sector is expected to boost the renewable energy industry because the invested fund will indeed reduce the high capital cost of the renewable energy sector.

Figure 2. Investment Uses of Green Bonds in 2016 and 2017 (Source: Climate Bonds Initiative, 2018)

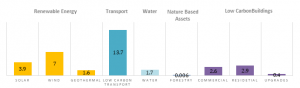

The data related proceeds from Certified Climate Bonds under the Climate Bond Standards across asset sectors also indicate that there are substantial investments for renewable energy sector. See Figure 3. A large portion of proceeds from Certified Climate Bonds and Loans for renewable energy is allocated to wind (20.71%), solar (11.54%) and geothermal (1.6%).

Figure 3. The Portion of Proceeds from Certified Bonds and Loans (amount USDbn) (Source: Climate Bonds Initiative, 2018)

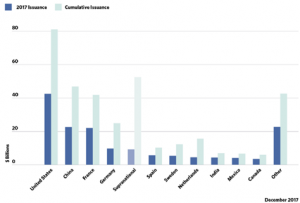

Although green bonds is an important mechanism for the development of renewable energy in the energy sector, we see an urgent need to formulate common international standards for Green Bonds mechanism. The Green Bonds market seems to be dominated by the issuance by developed countries, such as U.S., China, France, and Germany. From Figure 4, the figure shows that these leading countries considered to have a strong policy as the foundation to support the Green Bonds financing framework. While the ASEAN region has just recently harmonize differences between green finance standards and definitions among the nation in the region. The ASEAN Capital Markets Forum launched the ASEAN Green Bonds Standards (ASEAN GBS) in November 2017. The standards intend to: (1) enhance transparency for issuers of the green bond, (2) reduce due diligence costs, (3) help investors to make informed decisions, (4) provides guidance to market participants on the use and management of proceeds, processes for project evaluation and selection, and reporting. This set of ASEAN GBS will indeed push for a standardised set of rules for green bonds across ASEAN member countries, but initiatives from other countries to formulate common international standards for Green Bonds remain unclear.

Figure 4. Cumulative and 2017 Green Bonds Issuance by Country (Source: Climate Bonds Initiative, 2018)

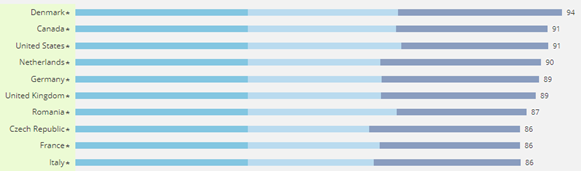

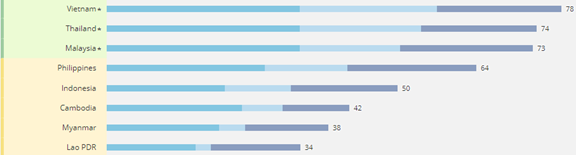

To formulate Green Bonds international standard in the energy sector, an indicator from the World Bank Group may able to provide a global assessment tool and benchmark. In 2014, The World Bank Group released a pilot report for a benchmarking tool to assess a nation’s policy readiness for investment in sustainable energy. Initially called RISE (Readiness for Investment in Sustainable Energy), the assessment tool can be used as a benchmark for Green Bonds standard formulation. The tool provides indicators of four main categories of assessment: (1) Planning, (2) Policies and Regulations, (3) Pricing and Subsidies, and (4) Procedural Efficiencies. These four categories are meant to assess the three pillars for sustainable energy development of Energy Access, Renewable Energy, and Energy Efficiency. By 2018, the RISE initiative managed to assess 112 countries’ RISE score with Denmark ranked first (Figure 5). While in ASEAN (except Brunei Darussalam and Singapore), Vietnam is the country most ready for nation’s policy in sustainable energy investment, followed by Thailand and Myanmar (Figure 6). Although the RISE indicators are able to provide a global assessment tool and benchmark for Green Bonds formulation in the energy sector, the main challenge is that there are more regions currently formulating their own regulatory benchmark rather than formulating common international standards for Green Bonds issuance.

Figure 5. Top 10 Ranked COuntries in the RISE indicators (Source: World Bank Group, 2018)

Figure 6. ASEAN Countries Ranked in the RISE Indicators (Source: World Bank Group, 2018)

It is also best for the formulation on international standards of Green Bonds to cover all aspects, including the definition of Green Bonds, the scope of the project, as well as the reporting mechanism in order to convince the investors that their fund will be used accordingly. Involving financial institutions is also needed in defining Green Bonds and formulating the standard. These institutions are important agents that could function as a cornerstone for investors in renewable energy, because financial institutions could participate in various innovative high projects and thus mobilizing the private capital to the Green Bonds market.

Bibliography

Climate Bond Initiative. (2018). Green Bonds Policy: Highlights from 2017. Climate Bonds Initiative.

World Bank Group. (2018, May 28). Scores | RISE. Retrieved from RISE Website: http://rise.worldbank.org/scores

* This opinion piece is the author(s) own and does not necessarily represent opinions of the Purnomo Yusgiantoro Center (PYC)