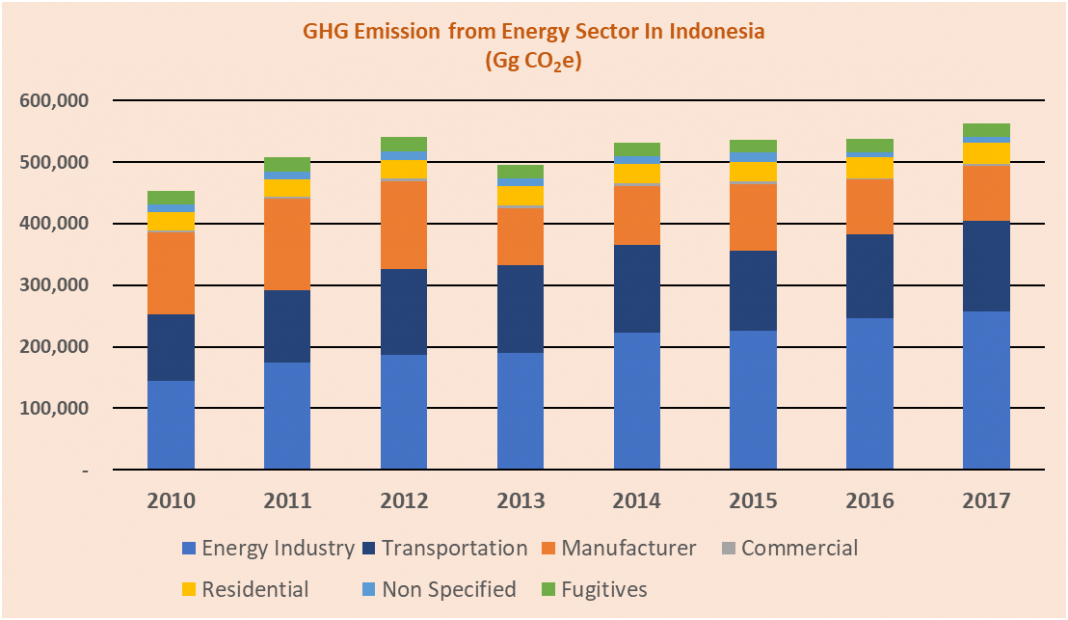

The transportation sector has the largest energy consumption in Indonesia. Moreover, this sector has a heavy reliance on fossil fuel. The sector accounted for more than 45% of final energy consumption in Indonesia in 2018 (ESDM, 2019). The share of non-fossil fuel is only 0.1%. Those facts make the transportation sector the second largest emission emitter from the energy sector, only lower than the emission from power plants (see Figure 1). Both sectors are still predominantly fossil-dependent sectors. Indonesia’s electricity is dominated by coal power plants, reaching 60% of the generation mix. The conditions above raise the question of whether Indonesia’s electric vehicles could reduce the emission or, otherwise, shift the emission from the road to power plant’s chimney. Thus, strategic plans and correct measures are required to develop electric vehicles (EV) effectively for emission reduction goals.

Figure 1 GHG Emission from Energy Sector in Indonesia (PYC, 2019)

According to IEA, policy and regulation have a significant role in boosting the EV market’s growth (IEA, 2019). Putting a set of clear policies and regulations makes a better view and boundary for the EV industry. Policy and regulation are also expected to open the EV market of a country. By the enactment of Presidential Regulation (PR) No. 55/2019, Indonesia jumped into the battery electric vehicle (BEV) industry race. The new PR remarked as the first regulation milestone of Indonesia’s EV pathway. No previous regulation specifically addressed on EV, although the General Plan of National General Energy Plan (RUEN), issued in 2017, has already mentioned a target of 2,200 4-wheel EV and 2.1 million 2-wheel EV by 2025. The PR enactment showed the government’s readiness to join the race of the EV industry, the future of mobility. The enactment also gave a start signal for EV industry players to develop the EV market in Indonesia.

PR No. 55/2019 provides a set of regulations for (1) Domestic BEV industry acceleration program, (2) Incentive provision, (3) Charging infrastructure and tariff, (4) Technical regulation, (5) Environmental protection. The supporting regulation is expected to finish by August 2020. Jokowi second-term goal is opening more jobs. One of the steps is to attract more investment in the EV industry. Hence, developing domestic EV industries is predicted to be the focus of the EV era in Indonesia.

Develop Domestic EV industry

Minister of Industry, Agung Gumiwang, targeted Indonesia to be the leading EV manufacturer by 2030 (Herman, 2019). Indonesia is an emerging automotive market industry in ASEAN, growing side-to-side with Thailand. Indonesia’s domestic demand for vehicles is growing year by year. Indonesia was the largest 4-wheels vehicle among ASEAN countries in 2019, contributing to 32% of the ASEAN market (Ardika, 2020). According to the Ministry of Industry’s data, from 2018 to 2019, Indonesia’s completely built-up (CBU) and completely knockdown (CKD) units export grew by 25.5% and 523%, respectively. However, sales and production of 4-wheels vehicles dropped by 10.5% and 4.2%, respectively. Different trends were pictured in 2-wheels vehicles’ sales, production, and exports as they had continued to grow year by year since 2016. The current performances and growth of Indonesia’s automotive industry could be an initial foundation for Indonesia’s EV industry development to cope the growing future global and domestic demand of EV.

Figure 2 Global Nickel Reserves (Suhartono, 2019)

The main challenge is to establish a local supply chain for the EV industry, from raw material, manufacturing, to EV market. On the raw material side, Indonesia holds a big opportunity by having the largest global nickel reserves (see Figure 2) (Suhartono, 2019). Nickel is a crucial material for EV’s battery to increase its energy density. The battery will hold not only an important role in the EV industry but also renewable energy. Thus, investment in battery industry is really crucial in the race of EV industry. The government could use the nickel reserve to lure EV investment in Indonesia (Suhartono, 2019). Last year, Jokowi pulled an unprocessed nickel ore export ban forward to January 2020, previously set in 2022, to keep the ore inside and to get more added value. Securing nickel resource was a good move from the government, but how to domestically utilize them will be more crucial steps. PR No. 5/2019 also regulates the minimum requirement for local content in the EV industry to boost the benefit to the local industry. EV production between 2019 to 2023 should achieve around 40% and of local content, and the standard will be gradually increased. However, the import is still allowed for a specified time limit before the industry ready.

A quick move is demanded by the government. Establishing a set of supportive regulation is crucial to provide an incentive for the industry and to encourage domestic demand. Otherwise, the EV companies and related industry, such as battery industry, could seek other locations for their industrial base. Then, this will be a major loss for Indonesia and its large nickel reserves could become nothing.

Boosting Domestic Demand of EV

Creating domestic EV demand is a crucial task to attract more investment and to achieve a clean transports transition. The high listing price of EV passenger car put a barrier to shift from a conventional vehicle to EV. According to Indonesia’s Ministry of Industry, most of the passenger car sales are in the price range of 200 to 300 million rupiahs. Incentives for EV are required to promote the transition to EV. Some incentives are proposed in PR No. 55/2019, as listed in Table 1. By the time of this writing, only a few incentive measures were regulated for the EV industry. The government issued a Government Regulation (GR) No. 73/2019 on Luxury Taxable Goods in the Form of Motor Vehicles Subject to Sales Tax on Luxury Goods (PPnBM) to encourage utilization of low emission vehicles. In the GR, the PPnBM rate considers fuel consumption and emission instead of the shape of the vehicle body. The GR gives tax reduction for Plug-In Hybrid, Battery, and Fuel Cell vehicles. The non-fiscal incentive had been issued by the Jakarta governor to exclude EV from road restriction. Those incentives untightened the barrier for the EV market. However, more incentive, both fiscal and non-fiscal, is clearly required to relieve the EV adoption constraints, especially for a private passenger car.

Table 1 Fiscal and Nonfiscal Incentives for Acceleration of BEV Adoption (PYC, 2019)

|

Fiscal Incentives |

Nonfiscal Incentives | |

|

|

|

*CKD: completely knock down, IKD: Incomplete knock down, SPKLU: Stasiun Pengisian Kendaraan Listrik Umum (Public EV Charging Station)

The government should start by electrifying public transport and motorcycle first. Electric public transports procurement will grow the initial market for the EV and be a means for public education. Furthermore, the price parity of an electric motorcycle and a conventional one is not as high as in the passenger car. Compared to car sales, motorcycle sales trend is more promising. The technology in an electric motorcycle is also not as complex as in the electric car. The government should also see the growing demand for motorcycle taxis as an opportunity to transform a conventional motorcycle into an electric one.

The availability of charging infrastructure is also a crucial aspect to grow EV demand. No one will purchase EV if charging infrastructure is lacking. Based on the WEF study, the availability of chargers is the main concern in adopting EV, followed by distance traveled on charge and cost (WEF, 2018). In Indonesia, PT PLN will hold the responsibility to build charging infrastructure in the initial state, as stated in the PR No. 55/2019. Incentives to build a charging infrastructure is demanded to grow the development from private business. WEF study highlights three business model which may be developed charging infrastructure: (1) marketing investment (provided by EV manufacturers to support own sales), (2) public-private partnership (free concession of public land, cost or revenue sharing), (3) regulated asset of electricity network operators (WEF, 2018).

Assessment of mobility pattern, either public transportation or private vehicle, is essential to place the charging infrastructure effectively both to suffice customer’s demands and to generate a revenue stream. Slow charging and fast (even ultrafast) charging technology are available in the market. The adoption will depend on the customer target’s mobility pattern. Slow charging may be suitable for outside the home charging or office parking lot. On the other hand, charging stations in a highway require fast charging technology to avoid spending to much time between travel.

Decarbonize first, EV later

Highly dependency on coal power plants could hamper the emission reduction goal by developing EV. The emission reduction benefit of EV transition depends on the total emission arise from the whole value chain, from material mining, battery, and vehicle manufacturing process, electricity production, to the end user’s EV technology. According to the IEA study, decarbonization of the power system holds the biggest emission reduction in the EV’s value chain (IEA, 2019). Emission reduction is higher in countries with low carbon intensity in their power system. Interestingly, the study also finds that hybrid vehicles produce lower emission compared to EV in countries where the power system is dominated by coal power plants.

Figure 3 Indonesia’s Power Plant Production (PYC, 2019)

Currently, coal power plant accounts for 60% of Indonesia’s power generation mix. In the General Plan of Electricity Provision (RUPTL) 2019-2028, coal will still dominate with 48% until 2028. The development of clean power generation has been creeping slow year by year. Renewable energy only accounts for 12% of the power generation mix until 2018. The main issue was the current unfavorable purchasing price for renewable energy. The purchasing price should be at least the same or lower than the local electricity generation cost (BPP). The current regulation cramps the development of renewable energy in the most populated and energy consumptive island. Java, Indonesia’s main island with the highest electricity demand, has a low BPP due to supply from coal power plants. Thus, a revision on current RE regulation is a first step to encourage RE investment and to develop cleaner power system.

A clean power system has a significant role in the success of emission reduction program from EV development. Incentive for charging stations which provide clean electricity, by solar PV or power wheeling, could be a solution to save more emission. Finally, decarbonization of power plants should be done hand in hand with the development of EV. Otherwise, the emission from EV will only move from the road to the power plant’s chimney. Thus, the government should review any regulation which hampers the development of clean power plant to achieve the EV program’s emission reduction goal.

References

Ardika, P. J. (2020). Kebijakan Pengembangan Industri Kendaraan Listrik di Indonesia. Jakarta: Kementerian Perindustrian.

ESDM. (2019). Handbook of Energy and Economic Statistics of Indonesia. Jakarta: ESDM.

Herman. (2019, November 29). Two Million Electric Motorcycles to Roll Off Production Line by 2025 . Retrieved from Jakarta Globe : https://jakartaglobe.id/business/two-million-electric-motorcycles-to-roll-off-production-line-by-2025

IEA. (2019). Global EV Outlook 2019: Scaling-up the transition to electric mobility. Paris: IEA.

PYC. (2019). PYC Data Center. Retrieved from PYC Data Center: https://datacenter-pyc.org

PYC. (2019). PYC Indonesia Energy Kaleidoscope 2019. Jakarta: PYC.

Suhartono, H. (2019, October 29). Indonesia Will Trade Its Nickel Riches for an Electric-Car Industry. Retrieved from Bloomberg: https://www.bloomberg.com/news/articles/2019-10-28/indonesia-will-trade-nickel-riches-for-an-electric-car-industry

WEF. (2018). Electric Vehicle for Smarter Cities: The Future of Energy and Mobility. Geneva: WEF.

*This opinion piece is the author(s) own and does not necessarily represent opinions of the Purnomo Yusgiantoro Center (PYC)