By: I Dewa Made Raditya Margenta

Introduction

Minister of Energy and Mineral Resources of Indonesia, Arifin Tasrif, stated that renewable energy (RE) in Indonesia has a massive potency and should be developed. However, RE utilization is still lacking. Currently, the RE realization for electricity in Indonesia has reached 32 megawatts (MW) out of 400 MW potency (Setiawan, 2019). Although this number indicates the national RE development still has plenty of room for improvement, it is a difficult task. Currently, 19 RE projects are struggling to get financial supports. State electricity company (PT PLN) informed that 9 out of 28 RE projects had fulfilled their responsibility as independent power producers (IPPs) (Indraini, 2019). Hence, the rest (19 RE projects) are still processed to solve this issue. National development planning agency (Bappenas) involvement through non-government budget equity financing (PINA) availability will be essential to achieve projects’ financial closing (Indraini, 2019).

The problem of obtaining financial support for RE projects was not a new issue. In 2017, the Ministry of Energy and Mineral Resources (ESDM) had 70 out of 75 RE projects found difficulty in achieving financial closing. Those projects are grouped into a large-scale capacity project and a small-scale capacity project. For large-scale capacity projects, the financing opportunity is still open by requesting bank loans or offering projects’ equity shares for their funding sources. This situation is opposite with small capacity projects which have to struggle in order to find financial supports. There are several reasons why investors in RE projects found hardship in obtaining financial support such as high interest on bank loans, and most banks are doubting the investors as they are not bona fide, especially for a first-timer.

RE Projects in Indonesia: Opportunities and Challenges

Even though some RE projects in Indonesia are encountering with earning financial support, it should not diminish its potency of RE development. Several reasons need to be considered why RE projects for electricity in Indonesia is still attractive.

First, competitive price compared to a coal power plant (outside Java). Figure 1 shows the levelized cost of electricity (LCOE) of a solar power plant in Riau, Aceh, or Bangka Belitung is higher than their local cost of generation provision (biaya pokok penyediaan/BPPs). Meanwhile, the LCOE of a wind power plant in Gorontalo, West Nusa Tenggara, or Papua is higher than their BPPs. It shows that RE projects are economically attractive to be launched in Indonesia besides Java. Also, rapid technology development will generate a new economic value of RE projects and its cost become more competitive than fossil fuel projects.

Figure 1. Comparison between regional BPP and LCOE of RE in Indonesia (Yusgiantoro & Yusgiantoro, 2018)

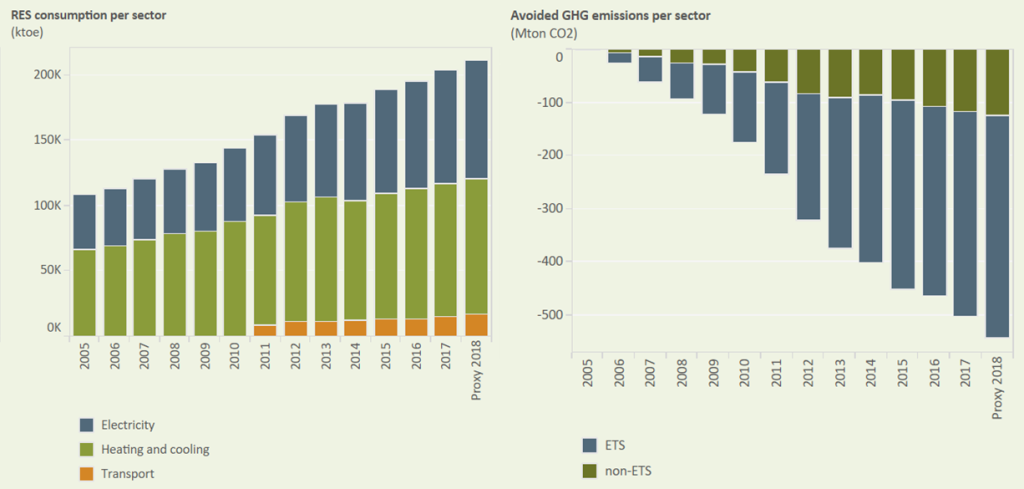

Second, Low operational expenditure (OPEX) due to the absence of fuel. As RE power plants are generated from renewable sources, it will lessen the operational cost because most of the engines are generated from the same source and minimized the use of fuel. Lastly, provide better air quality. The utilization of RE has significantly dropped the amount of carbon emitted to the air and provide better air quality. RE consumption for electricity, heating and cooling, and transportation has significantly affected the avoided amount of GHG emissions in several countries in Europe (figure 2).

On the other hand, several factors such as high capital expenditure (CAPEX), looking loans with low interest; intermittency; and unstable regulation, especially about Fit-in-Tariff and local content, become an inhibiting factor for RE development in Indonesia.

Figure 2. The effect of RE utilization to minimize GHG emissions: EU case (European Environment Agency, 2019)

Financial Options for RE Projects Funding

In order to earn financial close, there are several requisites that IPPs need to accomplish, such as location permits, land acquisition, feasibility study, and funding. Several factors such as natural resources availability, technical maturity (which determines the stage of development), the financial viability of renewable energy technologies and support via government policies and the regulatory will determine whether RE projects will be funded or not (Lam & Law, 2018). In general, three types of financial options can be used to fund RE projects: debt, equity, and grants and subsidies.

- Debt can be obtained by requesting banks or other financial institutions loans or issuing bonds through the capital market. A loan is often used to financing RE projects. However, bond finance for RE projects can be a cheaper means than commercial loans and affords a recycling opportunity to limited amounts of construction capital through refinancing initial project expenditures (Waughrey & Kerr, 2013).

- Equity financing is the process of raising capital by selling shares to potential investors. Different types of equity investors will be engaged depending on the stage of technology development, rates of return, and the degree of associated risk (Justice, 2009).

- Grants and subsidies are some funds that are often given by governments and public agencies to commercially marginal projects.

Generally, most of RE projects are funded through bank loans or equity capital. These financial options have their critical features in terms of funding source, target, risk, return time, and benefit. A study from Donastorg (2017) has successfully distinguished these funding types in table 1. In many cases, uncertainty due to future cash flows or low expected profitability may prevent financial institutions from investing in the project. Crowdfunding can often fill this gap.

Table 1. Critical features in RE projects funding (Donastorg, Renukappa, & Suresh, 2017)

| Equity | Loans | |

| Source of Funding | Wide range of sources (Insurance companies, pension funds, mutual funds, Stock Market, Real State and more) | Financial Institutions (Banks) |

| Target | New Technologies, Methods, and Markets | Mature Technology and markets |

| Risk | Low-Medium -High (Depending on the source of funding) | Low risk |

| Return time |

3-10 years (Depending on the RE project and on the equity that is funded) | 2-5 years (Depending on the specific terms of the Loan) |

| Types | Venture Capital, Private Equity and Funds | Personal, Commercial, Small business and more |

| Return | Low- Medium-High | Low |

| Benefits | 1. Diversity 2. Liquidity 3. Public Trading transparency of the market price |

1. Money guarantee 2. None involvement in the RE project by the banks 3. Accessibility and options 4. Tax Benefits |

Crowdfunding as an alternative funding source

Other than bank loans, equity capital, or grants, RE project proposers should consider crowdfunding as the alternative financing option. Crowdfunding is an alternative finance form that has become a popular financing tool in the last couple of years (Candelise, 2015). Crowdfunding utilizes the internet (via personal pages or websites), known as a crowdfunding platform, to tap the crowd of web surfers and mobilized them to finance RE projects. This tool is very effective for proposers of green projects to reach potential funders who seek investment opportunities, also supporting the transition to renewable energy and a sustainable environment. The funding provided by crowdfunders will exchange for some monetary claims in terms of project revenues, an economic reward, or solely for donation. Therefore, it determines different business models of crowdfunding (Bonzanini, Giudici, & Patrucco, 2016):

- equity-based: crowdfunders become shareholders of the project and have the right to share the profits (sometimes with differential voting power and dividend distribution rights, compared to the sponsor);

- lending-based: funds are paid back, and the crowdfunders have the right to receive an interest payment contractually promised;

- donation-based: funds are provided with no other compensation, for philanthropic or sponsorship proposal;

- reward-based: funds are provided in exchange for nonmonetary benefits

Besides being a fundraising tool, it also offers excellent marketing and benefits through its potential for building a community.

In Indonesia, the national financial services authority (otoritas jasa keuangan/OJK) has officially released the regulation regarding equity crowdfunding (Otoritas Jasa Keuangan Republik Indonesia, 2018). The regulation governs several aspects such as the period of an equity offering to public, the total raising fund, the number of shareholders, a minimum capital of crowdfunding platform and some prohibiting actions. As of November 2019, there are two equity crowdfunding platforms already have operating permits, Santara and Bizhare (Sari, 2019). Several other platforms have requested the permits and already in process.

Crowdfunding offers several benefits to the proposers of RE projects. First, it can reduce and share the risk among several small investors, avoiding bank debt, and the covenants often requested by credit institutions (Bonzanini et al., 2016). Second, crowdfunding can finance very small projects that are commonly neglected by professional investors or financial institutions due to economically unattractive or uncertain future cash flow. Then, crowdfunding also helps to conquer the “not in my backyard” phenomenon, by local communities’ involvement in the developing and financing the project.

On the contrary, crowdfunders have little bargaining power toward the project promoters. Contrary to professional investors like banks or venture capitalists, they are not able to impose covenants or agreements (Giudici, 2015). The risk of fraud and misinformation also huge. Equity-based crowdfunding also requires administrative and government acceptance, so it may take time and affect the project continuity.

Application of Crowdfunding in RE projects

The opportunity of using crowdfunding as a financial source has been explored by several RE projects in Europe and South America. The study conducted by Bonzanini (2016) explains that as of June 2014, there are 13 crowdfunding platforms specialized in RE projects. Those platforms have their business model and financing RE projects from various energy sources (Table 2). The study shows that the average success ratio for generic crowdfunding campaigns under the lending and equity-based scheme is equal to 92% and 44%. It can also be inferred that expected profitability is the key determinant of a successful campaign. Meanwhile, for a RE project that has low profitability, local communities’ involvement is essential.

Table 2. List of crowdfunding platform specialized in RE projects (Bonzanini et al., 2016)

The existence of crowdfunding should be treated as an oasis amid the difficulty of RE project financing in Indonesia. The RE project proposers should consider using crowdfunding as their funding source, especially for the newcomers in this industry. The proposers should have a solid commitment to run the projects and a transparent financial report. Also, the expected profitability should be well calculated and realistic as it is the key determinant to attract potential funders. Then, the proposers should construct a robust portfolio and ease the communication access as it will minimize the risk of misinformation and create an attachment to the potential funders. At last, if the RE projects are funded, operated as scheduled, the funders earn their claims, Indonesia is one step ahead to provide clean energy and to strengthen its energy security to achieve a better future.

Conclusions

In conclusion, crowdfunding should be viewed as an alternative funding source, especially in RE projects. Through crowdfunding, a small-scale RE project, which often being ignored by various financial institutions due to low profitability, can be fully funded. It also can encourage local involvement to participate and to maintain their RE power plants in their neighborhood. However, little bargaining power toward the project promoters and the risk of fraud became are barriers that need to be dealt with.

Several RE projects in multiple countries have utilized crowdfunding as their financing option, and lending-based crowdfunding has a high success ratio for funding those projects. The key factor in earning this funding is attractive expected profitability. These findings should be a silver lining for RE development in Indonesia, which is currently facing funding difficulties. The RE project proposers should understand this platform is worth to be tried as the potential funders have similar goals in encouraging renewable energy transition and a sustainable environment. If Indonesia’s RE projects earn a financial close, this country is approaching a better future and bolstering its energy sector.

References

Bonzanini, D., Giudici, G., & Patrucco, A. (2016). The Crowdfunding of Renewable Energy Projects. In Handbook of Environmental and Sustainable Finance. https://doi.org/10.1016/B978-0-12-803615-0.00021-2

Candelise, C. (2015). Crowdfunding and the Energy Sector. (18), 1–11.

Donastorg, A., Renukappa, S., & Suresh, S. (2017). Financing Renewable Energy Projects in Developing Countries: A Critical Review. IOP Conference Series: Earth and Environmental Science, 83(1). https://doi.org/10.1088/1755-1315/83/1/012012

European Environment Agency. (2019). Renewable energy impacts dashboard. Retrieved March 24, 2020, from https://www.eea.europa.eu/themes/energy/renewable-energy/renewables-crucial-for-eu-decarbonisation

Giudici, G. (2015). Equity crowdfunding of an entrepreneurial activity. In: Audretsch, D.B., Lehmann, E.E., Meoli, M., Vismara, S. (Eds.), University Evolution, Entrepreneurial Activity and Regional Competitiveness. Springer.

Indraini, A. (2019). Nasib Proyek EBT: 4 Mandek, 19 Berjuang Cari Pembiayaan. Retrieved March 24, 2020, from https://finance.detik.com/energi/d-4745943/nasib-proyek-ebt-4-mandek-19-berjuang-cari-pembiayaan

Justice, S. (2009). Private Financing of Renewable Energy.

Lam, P. T. I., & Law, A. O. K. (2018). Financing for renewable energy projects: A decision guide by developmental stages with case studies. Renewable and Sustainable Energy Reviews, 90(April 2017), 937–944. https://doi.org/10.1016/j.rser.2018.03.083

Otoritas Jasa Keuangan Republik Indonesia. (2018). Peraturan Otoritas Jasa Keuangan No. 37/POJK.04/2018 Tentang Layanan Urun Dana Melalui Penawaran Saham Berbasis Teknologi Informasi (Equity Crowdfunding).

Sari, I. N. (2019). Awal Desember, baru dua penyelenggara equity crowdfunding dapat izin OJK. Retrieved April 2, 2020, from https://investasi.kontan.co.id/news/awal-desember-baru-dua-penyelenggara-equity-crowdfunding-dapat-izin-ojk

Setiawan, V. N. (2019). Menteri ESDM: Pemanfaatan EBT Minim, Hanya 8% Dari Potensi 400 MW. Retrieved March 24, 2020, from https://katadata.co.id/berita/2019/11/06/menteri-esdm-pemanfaatan-ebt-minim-hanya-8-dari-potensi-400-mw

Waughrey, D., & Kerr, T. (2013). The Green Investment Report: The ways and means to unlock private finance for green growth. In World Economic Forum. Retrieved from http://www3.weforum.org/docs/WEF_GreenInvestment_Report_2013.pdf

Yusgiantoro, P., & Yusgiantoro, L. (2018). Ekonomi Energi, Teori dan Aplikasi. Jakarta Selatan: Yayasan Purnomo Yusgiantoro.

*This opinion piece is the author(s) own and does not necessarily represent opinions of the Purnomo Yusgiantoro Center (PYC)