The year 2006 marked a new era of Indonesia’s energy sector with the implementation of Presidential Regulation Number 5/2006. This regulation was meant to jump-start the renewable energy industries in Indonesia which have a significant potential for energy to be exploited. The regulation was then followed by the Constitution (UU) Number 30/2007 about National Energy Policy (KEN) and Government Regulation (PP) Number 79/2014 which stated that Indonesia’s Energy Mix should consist of at least 23 percent share of Renewable Energy (RE) by 2025. With the growing needs for energy, especially electricity, renewable energy based power-plants including Geothermal, Solar, Hydro and Wind were made as a priority source of energy. With the current ambitious target of 35,000 MW additional plant capacities between 2014 and 2019, how far have Indonesia’s renewable energy contributed in 12 years from their jump-start? And how far are we from the 2025 target of 23 percent renewable energy share?

Starting Line

One of the most important aspects in fulfilling its ambitious target is for Indonesia to diversify its source of energy. Indonesia highly depends on coal as well as on oil and gas to be its primary source of energy. The only renewable sources that have a significant contribution to the energy mix in Indonesia were Hydro and Geothermal Power Plant. With an increasingly high demand for energy consumption, the dependence on a specific energy source will put Indonesia’s energy security on a fragile thread. Energy diversification will not only help in fulfilling the energy demand but also in securing Indonesia’s energy sector.

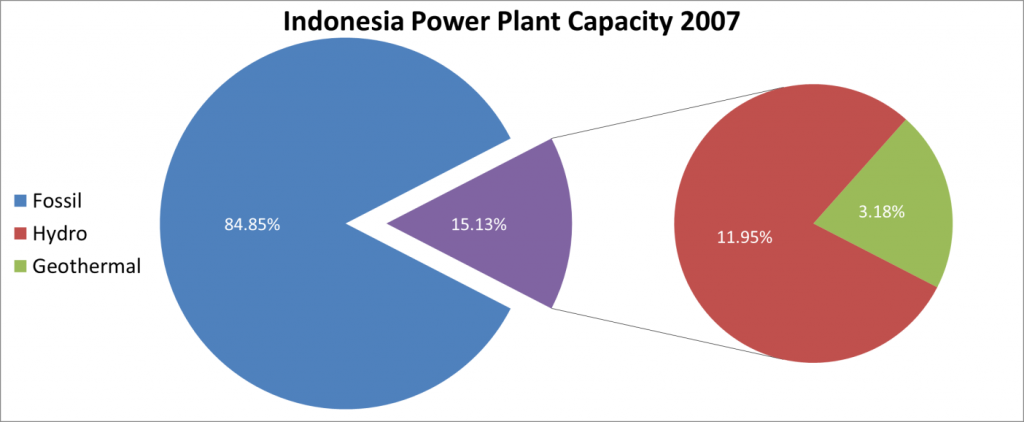

Figure 1. Indonesia’s Power Plant Capacity in 2007 (Source: Ministry of Energy and Mineral Resources of Indonesia, 2017)

In 2007, from 30,853.78 MW of the total installed power plant capacity in Indonesia, only 4,674.72 MW (15.13%) were from renewable energy sources while the rest were from fossil fuel. From the 15.13% share of renewable energy, 11.95% was provided by Hydro Power Plant, 3.18% was from Geothermal, and none came from Wind, Solar, Biomass, Micro- and Mini-Hydro Power Plant (Figure 1). This figure also shows that out of the 4,674.2 MW renewable energy power plant installed in 2007, 79% was from Hydro Power Plant and 21% was from Geothermal Power Plant. Given that Hydro and Geothermal Power Plant were already a relatively established and matured technology in Indonesia, it is understandable that the renewable energy sources were dominated by these types of power plant. On the other hand, the other renewable energy sources including Wind and Solar Power Plant were still in their research and development stage in Indonesia thus they have a significantly low share in the renewable energy mix. Considering that the Presidential Regulation Number 5/2006 has just been applied in 2006, it will take a considerable amount of time for Indonesia to catch-up to the technological maturity of other renewable energy sources such as Solar and Wind Power Plant and exploit their vast potential in Indonesia.

Significant Growth

A significant growth of renewable energy sources mix was reached by Indonesia in an effort to diversify its less developed renewable energy sources, especially in Wind, Solar, Waste, Micro- and Mini- Hydro Power Plant, from 2007 up to 2016. From Figure 2, the most visible growth is from Mini-Hydro as well as Micro-Hydro Power Plant. A considerably significant increase was expected to be due to the similarity of technology between these two power plants to the larger Hydro Power Plant. While Waste Power Plant proved to have a relatively large increase from 2007 to 2012, but it had stayed at the same level from 2012 to 2016. On the other hand, the Solar Power Plant showed a steady increase from 2007– 2016. The steady gain of Solar Power Plant growth was due to the technological breakthrough of Solar PV as well as the fact that Solar Power Plant can provide electricity to Indonesia’s remote and off-grid area due to its relatively straightforward installation. Meanwhile, Wind Energy Power Plant was the least developed renewable energy source with only 0.02% of share in the mix from 2012 – 2016. The main problem with wind energy is the delicate facilities as well as the relatively high initial cost to install.

Figure 2. Renewable Energy Share Growth in Indonesia (2007-2016) (Source: Ministry of Energy and Mineral Resources of Indonesia, 2017)

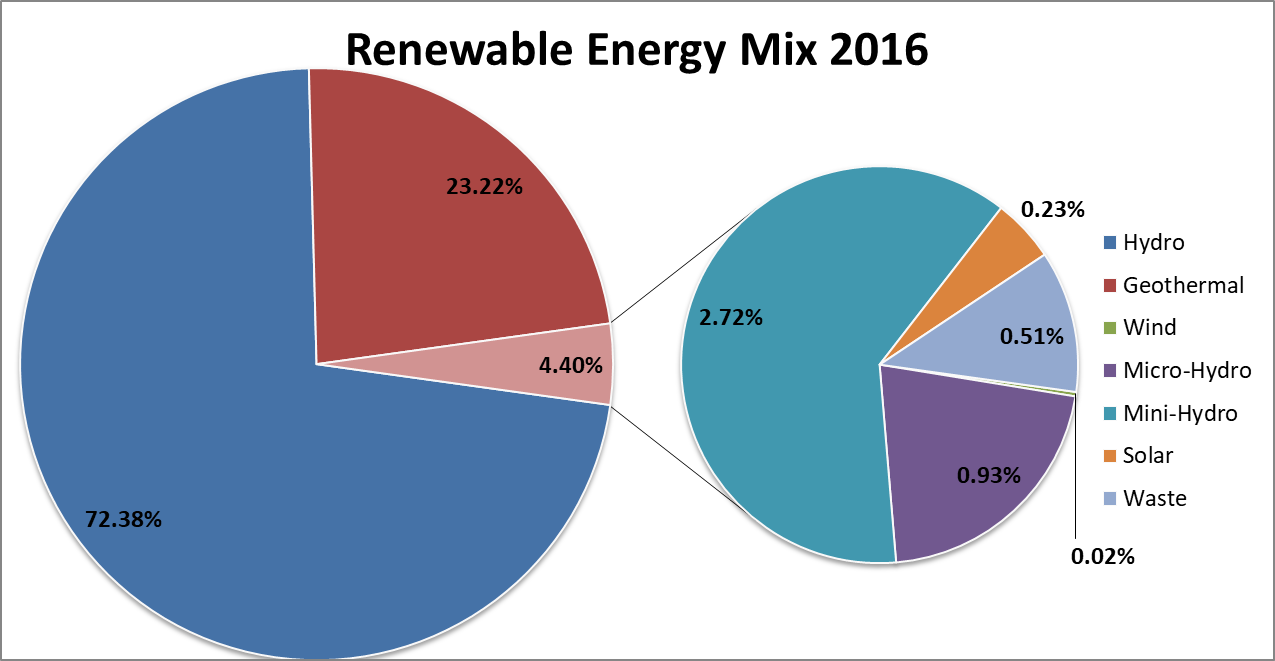

Figure 3. Renewable Energy Sources Mix in 2016 (Source: Ministry of Energy and Mineral Resources of Indonesia, 2017)

Current Stage

After 10 years of the regulation implementation, the government efforts to diversify Indonesia’s energy sources started to show its results. While Hydro Power Plant is still the dominant source of renewable energy, its share was significantly lower (72.38%) in 2016 (Figure 3) compared to the share in 2007 (79% of the Renewable Energy Share), as seen in Figure 1. The newly developed Wind, Solar, Waste, Micro- and Mini-Hydro Power Plant shared the energy burden together and took 4.40% of the share in total. Geothermal Energy also took its portion of growth where it only took 23% of the share in 2016 compared to the 20% share in 2006. In general, Indonesia’s effort to diversify its energy source already took its first step and showed a promising sign in the near future. However, in terms of capacity, with still only 7,079.03 MW installed capacity in 2016, a considerable effort is still needed to develop the renewable energy contribution to the nation’s energy mix.

With less than 10 years to reach the ambitious 35,000 MW, Indonesia needs to step up its effort, especially in the renewable energy sector. While the diversification effort started to show its results, renewable energy’s capacity increase is still the main problem. The current government tried to attract more investors by creating a secure renewable energy investment climate with regulations that will not over-complicate the effort to reach that goal. In 2017 alone, a total of 70 Power Purchase Agreements (PPAs) were signed with a total of 1,214 MW power plant capacities. This is a significant increase compared to the years before where there were only 15, 14, and 16 PPAs signed in 2014, 2015, and 2016 respectively. A large number of PPAs signed by the government was a result of the implementation of Minister of Energy and Mineral Resources (MEMR) Decree Number 12/2017 which regulated the pricing of renewable energy to be sold to the National Electricity Company (PLN). The decree not only regulated the price but also stated that all electricity produced by renewable energy power plant would be utilized. Moreover, the Ministry also issued MEMR Decree Number 50/2017 which regulated the utilization as well as the investment procedure for renewable energy resources. Both regulations were expected to convince the renewable energy sector investors that the government fully support the renewable energy industry.

What’s Next?

The remaining 7 years will be an important last run for Indonesia. With most of the regulations are already in place and maturing technological capabilities, renewable energy will be expected on the run until 2025 to fulfill the ambitious goal settled by the government. Unlike in 2007 where the technological aspect is the main problem in renewable energy advancement, the main challenge now is to attract investors to the renewable energy sectors. Although PPA pricing is now has been regulated, the negotiations between Independent Power Producers (IPPs) and PLN still drag-on within both parties to determine the best deal for them. The government should be the mediator between the negotiations so that the best pricing that will benefit both IPPs and PLN can be met and will accelerate the renewable energy growth in Indonesia.

In conclusion, Indonesia has gone a long way since the start of their renewable energy campaign in 2006, especially on diversifying its energy source. However, another jump-start to further stimulate the investment in the renewable energy industry is needed, especially in the next 5 years as in terms of capacity; thus, a huge gap will still need to be covered. Tax exemption, ease of permit and permission as well as an incentive can be considered to be the catalyst to further enhance the renewable energy industry in Indonesia.

Reference

Handbook of energy & economic statistics of Indonesia 2017. (2017). Jakarta: Ministry of Energy and Mineral Resources, Republic of Indonesia.

* This opinion piece is the author(s) own and does not necessarily represent opinions of the Purnomo Yusgiantoro Center (PYC).