By: I Dewa Made Raditya Margenta

Research Assistant at Purnomo Yusgiantoro Center (PYC).

Global energy demand will continue to grow by 18% to 2030 driven by a rising population and sustained economic momentum in emerging markets [1]. The demand in Asia Countries are going to rise significantly, and industry and transportation are the sectors that influenced the rising of energy demand (Figure.1)[2]. These sectors are essential for the development of some countries, especially in Southeast Asia. Therefore, Southeast Asia countries must find a way to fulfill their energy demand, and one of the solutions is by developing renewable energy. The International Renewable Energy Agency (IRENA) said that Southeast Asia is a potential hotspot for renewable energy, yet the region has not met expectations because it lacks policy frameworks that would encourage investment [3]. However, renewable energy development nowadays is more friendly because of technological development, regulatory support, and business innovation have enabled a revolutionary leap in bringing down the cost of renewable energy in recent years. This situation offers a promising business chance for some well-established companies, and indeed, an oil and gas company would love to join in. Until now, some major oil companies such as Big Oil, Royal Dutch Shell, Statoil, Exxon, Total, and British Petroleum have invested in renewable energy development for their business. Their reasons are:

- To showcase commitment towards green energy to government, public and private agencies and to the general public in light of heightened awareness towards climate change and stakeholder pressure

- To diversify their energy portfolio knowing the potential of renewable energy in the future and its increasing competitiveness vis-a-vis fossil fuels

- Oil prices are vulnerable

Figure 1. BP Outlook Energy 2019

Malaysia state-owned oil and gas firm (Petroliam National Berhad/Petronas) is the latest oil and gas major to look into the renewables space. Petronas has expressed interest over the last year to diversify into renewables amid low oil prices. Petronas will explore new business areas including new energy and that the company will assess opportunities in solar power [3]. At this moment, Petronas is in talks to enter India’s solar energy firm, and it shows the commitment of Petronas on renewable energy development.

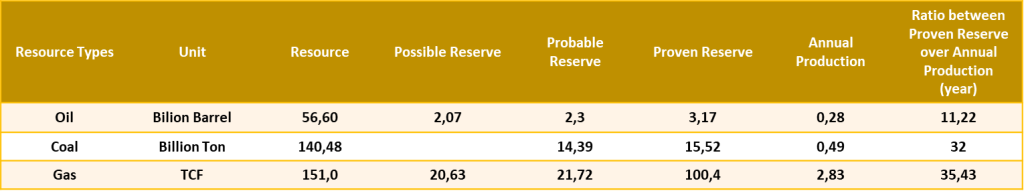

In Indonesia, the reliance on fossil fuel as our primary energy source is high, even though its production is half lower than its domestic consumption. Moreover, oil production has been decreasing since 2003. As a result, the national energy resistance in the oil sector is weaker than other resources (Table.1)[4] and may give a significant impact if this situation is poorly handled. This condition has pushed Indonesia state-owned oil and gas firm (Pertamina) to optimize their concessions. Also, Pertamina needs to find another option to identify what is next for their business. At the same time, Indonesia has shown their assurance on green energy development by targeting 23% of their energy source come from renewable energy in 2025 [5]. This topic becomes interesting by analyzing Pertamina’s decision between investing in renewable energy or persisting on exploring the reservoir in Eastern Indonesia, will offer a better future.

Table 1. Indonesia’s Conventional Energy Reserve

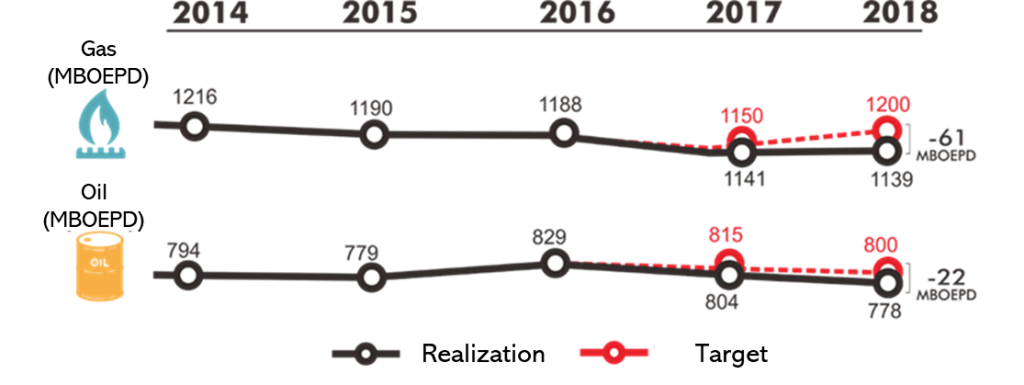

Fosil fuels in Indonesia is widely used for some important sectors such as transportation (as a fuel), electricity (as a source for Integrated Gasification Combined Cycle Plants), household industry (LNG, LPG, and Gas line), and petrochemical industry. The existence of these sectors is influencing national growth. Therefore, the availability of fosil fuel for an extended period will be crucial. Sadly, the realization of oil and gas production was lower than its target in the last two years (Figure.2)[4]. This issue becomes the biggest homework for the government (as a regulator) and Pertamina (as a provider) to increase production. At this moment, Pertamina has taken over the Mahakam field and will take the Rokan field in 2021. The acquisition has a significant impact and might assist in increasing production. However, Pertamina still needs to find a way to explore any options to rise their reserves and production because these fields have been explored since 20 years ago.

Figure 2.Comparison between Target and Realization of Fossil Fuel Lifting

In my opinion, several options can be considered by Pertamina to increase their reserves and production such as;

- Optimizing their concessions through advance technology. Nowadays, technology in the oil and gas industry is well developed and offers a better result. Enhance oil recovery (EOR) and basement fracture are the results of advancing technology. EOR is beneficial to enhance the oil production which is trapped in the pore. This method is well to be applied to a brown field which is commonly found in Western Indonesia. Also, EOR has been used in the Rokan field by Chevron. Basement fracture is the other way to produce oil and gas by cracking the basement rock. The purpose of this method is to increase the permeability so that the hydrocarbon might flow through the gap created. The gas discovery in the Sakakemang field (2 TCF) is the latest result of the using of basement fracture in Indonesia.

- Pertamina must consider the exploration in Eastern Indonesia. There are 74 out of 126 basins still poorly explored, and most of these basins are located in Eastern Indonesia and offshore[6]. This information must be considered as a chance for discovery. A better data gathering through the latest technology and better human resources will significantly decrease the uncertainty and increase the possibility.

Implementation of these options is not easy. Several factors are needed to be considered to avoid any blunder and might ruin the business such as;

- The vulnerability of oil prices. In 2015, the oil prices hit rock bottom by reaching $40 per barrel due to oversupply from the US and increased production in Russia and Saudi Arabia[7]. It was not the first time the oil price varied over time due to it was affected by some factors such as politics, war, and over-supply. It is also predicted that the oil price might go lower again in the future. This vulnerability must be well handled by Pertamina to avoid any significant economy impact which may strike directly out of nowhere.

- Advance technology is expensive. As I mentioned before, the use of advance technology such as EOR and basement fracture is helpful to satisfy the national demand for fossil fuel. However, the price of these technologies is high. The surfactant of EOR is not produced by Indonesia or still on development by the government by mixing with crude oil. Therefore, Pertamina needs to import, and it is pricey. Until Indonesia has not established the affordable EOR surfactant, the decision of using EOR must be well considered. Also, EOR cannot be applied to all oil fields due to its economic value.

- The exploration risk in Eastern Indonesia is high. This condition is happened due to several reasons such as the supporting infrastructure is not ready yet, and the cost of data acquisition is expensive. Therefore, Pertamina needs to maximize potency through the feasibility study of the interest area.

If Pertamina wants to take part as a sustain oil and gas provider and still get profit, these options must be well analyzed by maximizing the resources they owned. However, by considering the risk and cost they would spend, I think Pertamina need to invest in renewable energy diverse their business core because the electricity demand, as main national needs, will rise in the next few years (Figure.3). The investment in renewable energy will beneficial for both parties (Indonesia and Pertamina). Pertamina will help Indonesia to fulfill the electricity needs and the target of 23% renewable energy source in Indonesia. At the same time, the electricity which Pertamina has produced always be bought by national electricity company (PLN) based on the regulation so that Pertamina will get profit.

Figure 3. Energy Conservation based on National Demand

Pertamina’s investment will show their commitment to green energy development and reduce carbon emission. This move will follow other oil and gas companies’ decisions. Until now, Pertamina has taken part in renewable energy development in terms of developing B100 with ENI (mixing fossil fuel with crude palm oil) and Geothermal power plant. Also, Indonesia owns the biggest geothermal potency in the world. The report says Indonesia’s geothermal potency can be maximized to reach 28,5 GW, but the implementation only reaches 1948,5 MW[8]. In another energy source, Pertamina had tried to develop renewable energy in joint operation business with PT Len Industri, PT EMI, and PT SMI in 2016[9], but until now, the progress report of the project is hard to be accessed. That is why Pertamina must commit to considering the possibility in other energy source and see the government vision as a guarantee of sustainable development in renewable energy. Therefore, the investment will be a good decision for the business. The investment will assert Pertamina’s position which is to be a world class national energy company. There are several reasons why Pertamina need to consider the investment in renewable energy such as;

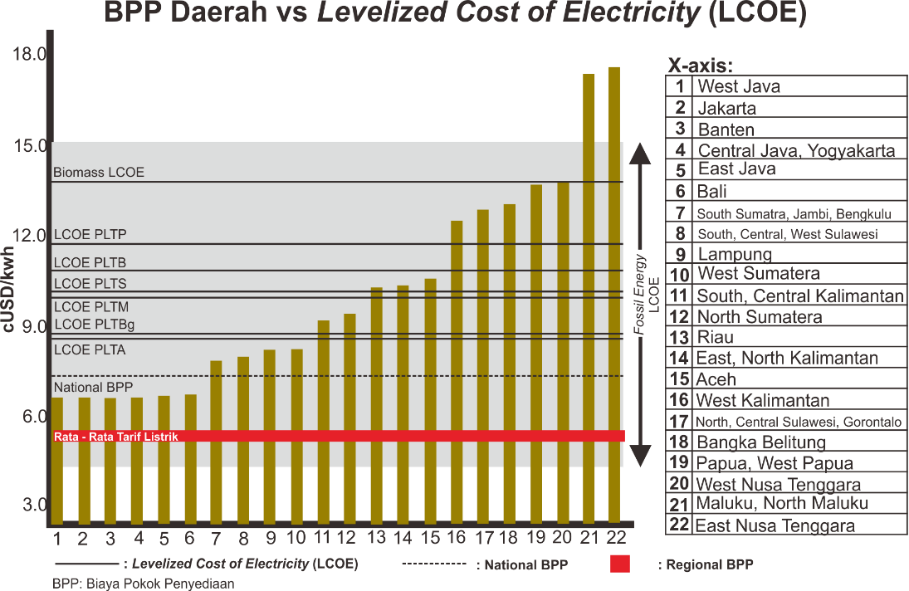

- The development of renewable energy can be done in several regions in Indonesia. Based on the comparison between region production cost (BPP) and Levelized Cost of Electricity (LCOE) using fossil fuel, LCOE is way higher than BPP in some areas[10]. It means that developing a renewable energy power plant in Indonesia has an economic value. The type of renewable energy power plant may differ from one to the other based on its geography.

Figure 4. BPP Regions vs. LCOE

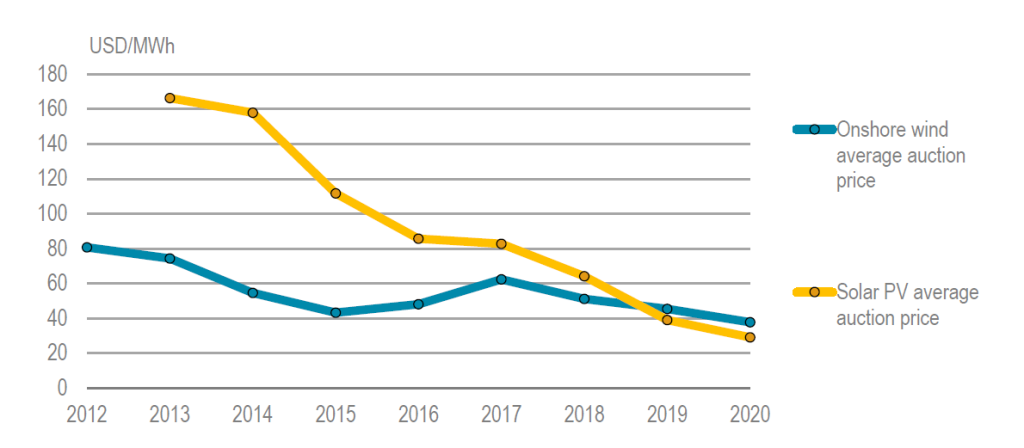

- Technology development in renewable energy has pushed the cost to be affordable. A decade ago, Solar PV was extremely expensive and did not ready yet for public used. As time passes by, technology has developed rapidly and affected the price of solar panels. As a result, solar modules now cost less than a dollar per watt of capacity. At this moment, the solar PV auction price is lower than onshore wind power plant (figure.6) and will be getting lower in the future[11]. This situation might also happen for another type of renewable energy source.

Figure 5. Comparison between Onshore Wind and Solar PV Auction Price

- Other state-owned oil and gas firm around the world has started to invest in renewable energy. Pertamina is not the only oil and gas company who spends on renewable energy. There are plenty of oil and gas companies that have been participating in that business. Pertamina, as a new player, can learn a lot for the others especially on their decision while facing some issues or problems in the renewable energy sector.

Before investing in renewable energy in Indonesia, Pertamina needs to analyze the risk which may face them such as;

- The established regulation was unfriendly for the investor (yet). There are some examples such as; The application of BOOT system is one of the reasons why several banks afraid and concerned about giving soft lending for the investor. The uncompetitive price also the other example of the unfriendly regulation. The state-owned electricity company (PLN) must buy the electricity which is produced by IPP but maximum 85% of BPP. That is why Indonesia’s position is on the initial stage [11].

Figure 6. Stages of Policy, Market and Financing for Renewable Investment, Selected Countries in 2017

- Infrastructure on the prospect area has not been promising (yet)

- Indonesia is the archipelago country. The construction of the power plant is not easy especially in some area which is difficult to be Therefore the production cost is higher compare to the accessible area, and make that area unintersted. This issue can be solved if the infrastructure is established and connected to every island.

- The intermittency of a battery.

The problems above can be solved by the government’s commitment to developing renewable energy and technology development. The cost reduction of solar and wind power plant is the result of it, and in the future, it is highly possible that the intermittency of a battery will get the best solution. If Pertamina decides to invest after all the problems above are solved, it will burden their economy and slow down their development as a world class energy company. Pertamina surely has realized that the challenge of getting fossil fuel is getting risky and cost much although Indonesia still has a significant potency and it offers a big profit immediately for the company. Pertamina must start their mission to be a world class national energy company by diverting their energy portfolio.

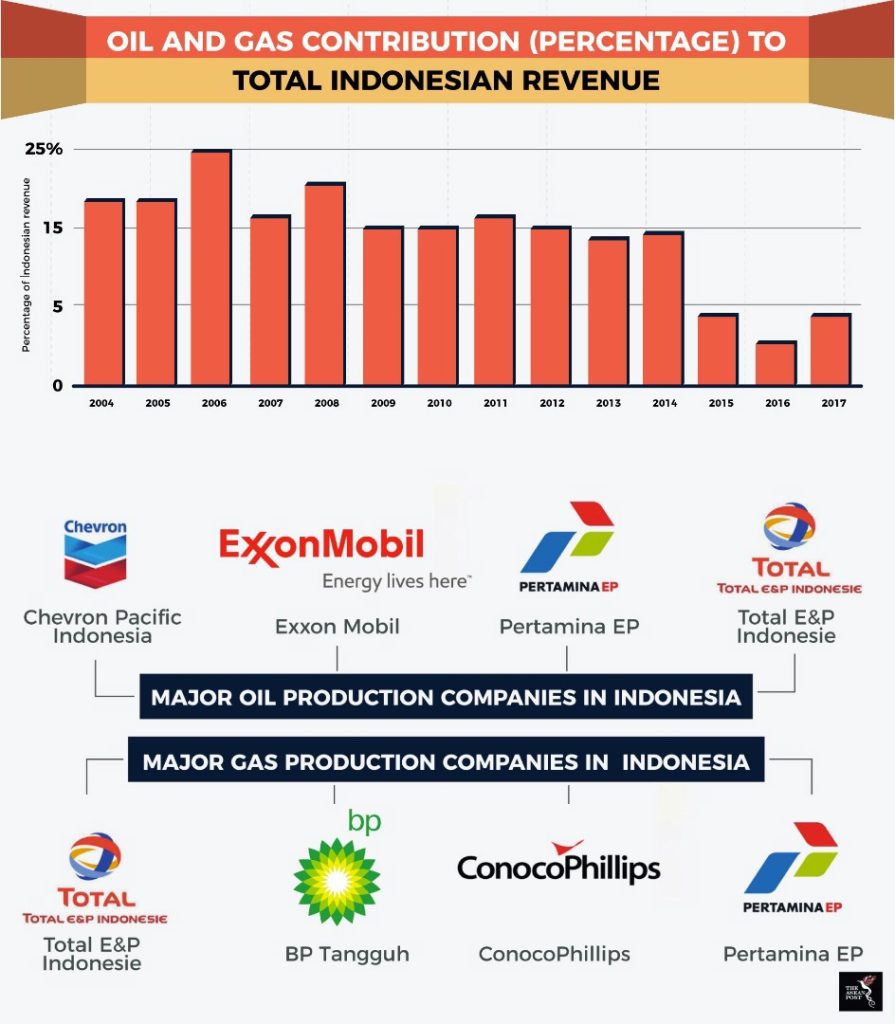

Although some of the regulations are not well received by the investors, Pertamina can still get profit by developing solar panel in Eastern Indonesia. West Nusa Tenggara is the area who has a constant sunshine duration and generating solar power plant is a good decision to start the investment in renewable energy. This initiative will be a power for Pertamina to invite the government to optimize energy diversification by allocate the fossil fuel for specific sectors only and increase the green energy. Pertamina can disenchant that Indonesia cannot rely much on fossil fuel as their primary energy sources due to the significant decreasing of national oil and gas revenue since 2015 (Figure.4)[12]. Therefore, this threat may push the government to show their commitment to renewable energy development through regulation.

Figure 7. Outlook Energi Indonesia 2017

In conclusion, the investment in renewable energy will be essential for Pertamina not only to establish their status to be a world class national energy company but also give them profit from other business core. As a national state enterprise, Pertamina must obtain a profit. The investment will not directly bring Pertamina to be a world class energy company and give an instant profit, but Pertamina can learn on how to develop renewable energy in Indonesia. Pertamina does not need to start from zero regarding the business decision because they can learn from other companies such as Petronas, as the latest oil and gas company who invests on renewable energy. In the beginning, Pertamina can pick a join operation business with other company to minimize any risk. As time goes by and Pertamina get a lot of experiences, Pertamina can be a single investor. The duration to be a single investor is related to the commitment of Pertamina on developing renewable energy. That is why the investment in renewable energy will offer a better future for Pertamina, and they have to start it soon.

References

- Petroliam Nasional Berhad, “Sustainability Report 2017,” 2017.

- British Petroleun, “BP Energy Outlook 2019,” 2018.

- Ananthalakshmi, “Malaysia’s Petronas sets up team for renewable energy push,” 2018.

- PYC Research Team, “PYC’s Energy Sector Insights and Recommendation 2018,” 2019.

- President of the Republic of Indonesia, “Presidential Regulation No. 22/2017 on National Energy Plan,” 2017.

- SKK MIGAS, “SEMINAR ENERGI NASIONAL NERACA ENERGI INDONESIA TINJAUAN KRITIS: MINYAK & GAS BUMI,” 2019.

- T. Daiss, “Worst Oil Crash In A Generation: When Will It End?” 2016. [Online]. Available: https://www.forbes.com/sites/timdaiss/2016/09/02/worst-oil-crash-in-a-generation-when-will-it-end-2/#66dd50d2446b. [Accessed: 25-Mar-2019].

- R. TPP, “ESDM Minister Pushes Geothermal Energy Development in Indonesia,” 2018. [Online]. Available: http://en.presidentpost.id/2018/09/28/esdm-minister-pushes-geothermal-energy-development-in-indonesia/.

- M. Saroh, “Kembangkan Energi Terbarukan, Pertamina Gandeng BUMN Lain,” 2016. [Online]. Available: https://tirto.id/kembangkan-energi-terbarukan-pertamina-gandeng-bumn-lain-za9. [Accessed: 25-Mar-2019].

- P. Yusgiantoro and L. Yusgiantoro, Ekonomi Energi, Teori dan Aplikasi, 1st ed. Jakarta Selatan: Yayasan Purnomo Yusgiantoro, 2018.

- IEA, “Japan-Indonesia Government-Private Workshop on Clean Energy,” 2019.

- E. Ariffin, “The decline of Indonesia’s oil and gas industry,” 2018. [Online]. Available: https://theaseanpost.com/article/decline-indonesias-oil-and-gas-industry. [Accessed: 25-Mar-2019].

Disclaimer: This opinion piece is the author(s) own and does not necessarily represent opinions of the Purnomo Yusgiantoro Center (PYC).