Added value activities for the mining sector will bring many benefits for Indonesia (Pixabay, Pexels).

Overview

The improvement in the downstream mining sector is essential so that we could get more benefits as in state revenue, employment, and many more. We must make strategic planning to get as many economic benefits as possible from our natural resources, in particular, coal and minerals. We need positive progress from just doing massive natural resources exploitation to improving the downstream sector, which could multiply our resources value. In the mining sector, the government has executed one of their initial strategies, which is by limiting or stopping the export of several ore minerals, such as nickel and bauxite. Thus, the mining companies must construct the processing or refining facilities to improve the added value of its minerals. Following this strategy, now the government must start carefully planning and aiming at the improvement of its downstream industries.

Steps in Coal and Mineral Added Value

Added value activity in the mining sector is divided into two steps, first is in the upstream sector, and the second is in the downstream sector. Currently, the government is focusing on promoting the added value activities in the upstream sector, which is a refining process for metallic, non-metallic minerals, and rock materials. The activities for increasing added value for metallic minerals include separation, extraction, and refining, with the output such as NPI, FeNi, Ni-Matte, Pb bullion, tin ingot, alumina, etc. (used for industrial feedstock). Meanwhile, the activities for non-metallic minerals include grinding, mixing, and upgrading, which produces pellet, catalyst, filler, coater, etc. Lastly, the added value activities for rock materials are crushing, grinding, and sizing.

On the other hand, the added value activities in Indonesia’s downstream sector is currently still underdeveloped. The activities in the downstream sector focus on manufacturing products for the end-user, such as machinery, electronic and steel (from metallic minerals), soap and drug (from non-metallic minerals), art, and building materials (from rock materials) and many more. The other potential of added value activities in the downstream mining sector that could be further developed in the near future is for coal. There are seven ways to improve the added value of coal, including coal gasification and liquefaction (to produce synthetic fuel), cokes making (for metallurgical use), underground coal gasification (to produce synthesis gas, in-situ), coal upgrading, coal briquetting, and coal slurry/coal water mixture. Therefore, while promoting added value activities in the upstream sector, it is also necessary to start planning on promoting added value activities in the downstream sector.

Why Promoting The Downstream Sector?

Promoting the downstream sector will give many benefits to Indonesia, it will not only increase state revenue and employment but also will provide other tangible and intangible benefits. Besides, Indonesia is still rich in mineral and coal reserves, namely nickel reserve at 3.57 billion tons, iron with 3.07 billion tons, gold 3.02 billion tons, silver at 2.77 billion tons, copper 2.76 billion tons, bauxite 2.38 billion tons, and tin at 1.21 billion tons (Asiatoday, 2020). Meanwhile, the Indonesia coal reserve is still at 37.60 billion tons, while the resource is even larger, at 149.01 billion tons (Asiatoday, 2020). Considering the benefits and the country’s reserves, it is important to immediately boost the added value activities in the mining sector even further.

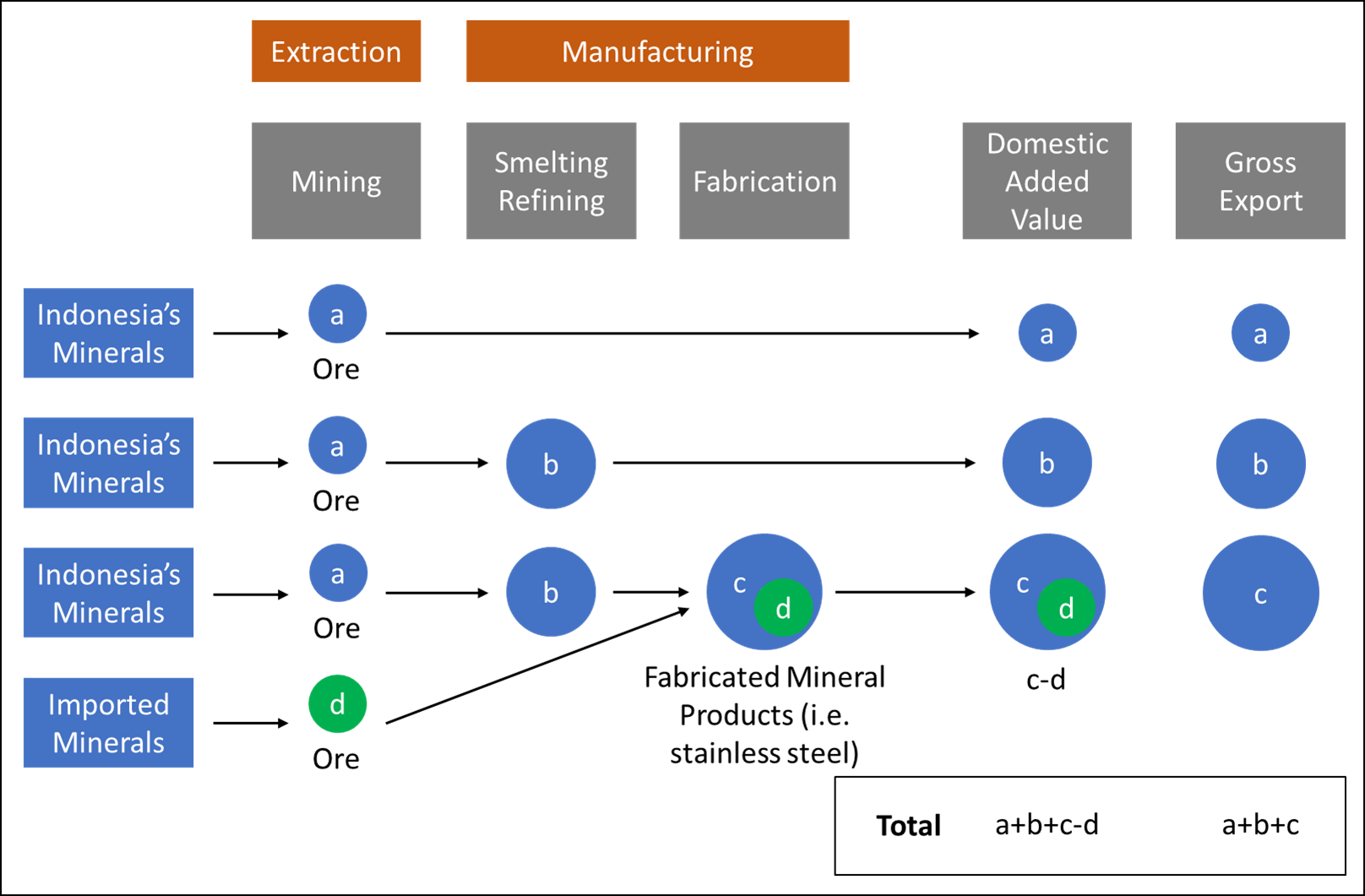

Figure 1. Impact of added value activities on gross export (Sukhyar, 2020, modified by PYC).

The impacts of added value activities are illustrated in Figure 1. A more advanced added value activities will give more return in term of gross export. If the ore is directly exported, it will have resulted in a small gross export (a). However, when it is processed through smelting or refining, the value will be expanded (b). In more advanced processing, sometimes it will require additional raw materials that need to be imported (d), and the resulted gross export will grow even more (e).

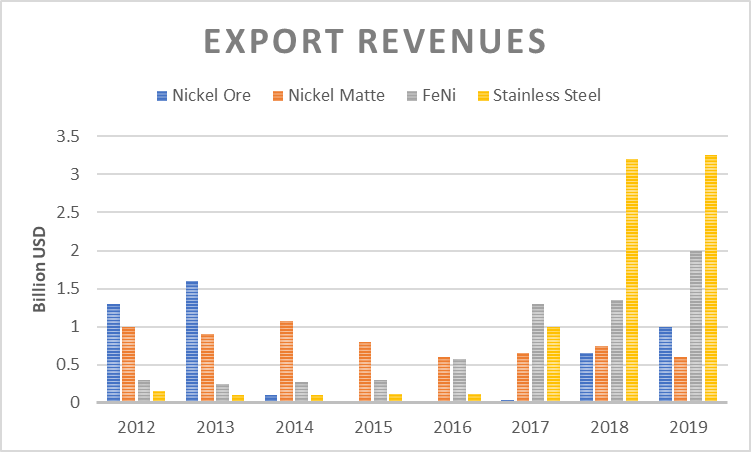

In terms of the multiplier effect, LPEM UI has done a study on it in the nickel industry. Table 1 shows that with the presence of smelting activities, the multiplier effect on output, revenue, and employment are about twice as big compared to only doing mining activities. Moreover, as in export revenue, the added value activities for nickel gave a tremendous boost in 2018 and 2019, compared to when Indonesia only focused on exporting nickel ore in 2012 (Figure 2). According to BPS (2019), the total export of nickel products in 2019 was around USD 7.1 billion, an additional USD 4.1 billion from export in 2012 at USD 3 billion. For the record, in 2019, Indonesia also successfully became the second biggest stainless steel exporter in the world. In addition, the nickel industries also help the local economy of Central Sulawesi, which has an average of 9.7% economic growth in 2015-2018. Nowadays, nickel industries are also growing in other areas such as North Sulawesi, North Maluku Utara, and Maluku.

Table 1. Comparison of multiplier effects from ore mining and smelting activities (Sukhyar, 2020).

| Ore Mining | Smelting | |

| Output | 1.44 | 3.07 |

| Revenue | 1.90 | 3.52 |

| Employement | 2.17 | 4.15 |

Figure 2. Export revenues from nickel (Sukhyar, 2020, modified by PYC).

Additionally, the added value activities for coal could give an enormous impact not only in terms of revenue but also in energy security. The coal gasification and liquefaction could reduce the import of fuels since they can produce synthetic fuels that can substitute for several types of conventional fuels. At the same time, coal gasification and liquefaction can improve low-rank coal value, which is abundant in Indonesia. The primary product of coal gasification is syngas, which can be processed to produce other products such as synthetic natural gas, diesel oil, gasoline, ammonia, urea, explosives, methanol, dimethyl ether, and formaldehyde. Therefore, the synthetic diesel oil and gasoline could reduce our country’s dependency on oil fuel import, while dimethyl ether could replace LPG (liquefied petroleum gas), which is another trade deficit in Indonesia’s trade balance. Meanwhile, coal liquefaction could directly transform coal into synthetic fuels and consequently, improve the production process’s efficiency. However, the technology of coal liquefaction is yet to be proved on a commercial scale.

Current Progress

According to Laporan Kinerja Tahun 2019 (2020), until the end of 2019, there are 17 mineral refineries operating in Indonesia. Most of them (11 refineries) are for nickel, 2 bauxite refineries, 2 copper refineries, a manganese refinery, and an iron refinery. In the future, the government already planned an additional of 35 new refineries by 2024. The planned new refineries consist of 18 nickel refineries, 7 bauxite refineries, 2 tin refineries, 3 iron refineries, a manganese refinery, and 4 lead and zinc refineries (Figure 3).

Figure 3 The progress of mineral refining facilities development (Ditjen Minerba ESDM, 2020, modified by PYC).

On the other hand, coal added value activities have also been established in several regions, mostly in Kalimantan, with four coal upgrading factories and a cokes making factory (Figure 4). There are two coal bracketing factories and a planned coal gasification factory in Sumatera. Also, there is a coal upgrading factory in Sulawesi.

Figure 4 Map of coal added value activities in Indonesia (PYC Data Center, 2020).

Opportunities

Increasing the added value of minerals must also be supported by developing the end-user domestic industries (industries that produce batteries, aircraft frames, engines, jewelry, etc.), so that mineral utilization can be maximized. Indonesia is still rich in nickel and copper, which are needed as raw materials for the automotive and battery industry. Thus, the government should focus on developing the automotive and battery industry in the near future. At the same time, the government should also continue to develop the refining activities for nickel and copper, so that they can support the supply of components/raw materials needed by the automotive and battery industries. In addition, one potential that can also be explored further is the technology of lithium extraction from geothermal brine water. Lithium is one of the most important minerals used in battery production. Since Indonesia has a huge potential in geothermal energy, the development of this technology will not only enrich the domestic mineral production but also provide added value to the geothermal sector.

The Role of Government

In order to develop domestic industries, there will be some challenges to be faced. Constraints such as energy supply, funding issues, and other issues (environment, forest area, and land acquisition) are some of the main issues in the industrial sector. Therefore, the role of the government in supporting downstreaming is very important, especially in determining appropriate policies and supporting incentives both fiscal (tax holidays, tax allowances, import duty facilities/exemption of import taxes, etc.) and non-fiscal (ease of doing business and foreign investment, guarantees in raw material supply, longer period of stock divestment, etc.).

In particular, for the automotive and battery industries, a clear road map on the strategic development plan is urgently needed. The government should impose a regulation that focuses on the implementation plan, as has been done for the mineral refining industry, through the ESDM Regulation No. 25/2018. Meanwhile, for the coal industry, the government needs to review the supporting policies and incentives for coal downstreaming. Several aspects that could be reviewed are royalty reductions, special coal price formulations for coal gasification/liquefaction, extension of mining license (adjusted to the economic life of the downstreaming project), certainty of product prices from coal gasification/liquefaction.

In addition, the technologies of the industries mentioned above need to be quickly mastered by Indonesian human resources. Thus, know-how and technology transfer are very important in developing the skills of Indonesian human resources and minimizing the use of foreign workers and imported technologies/facilities. Furthermore, the industries need to be encouraged to use domestic raw materials and strengthen working relationships with local goods and services businesses. Moreover, the government also needs to study the impacts on the environment so that industrial development can improve the economy without sacrificing the environment. With thorough planning, the development of these industries will increase the state revenue (tax, royalty, etc.), empower Indonesian human resources, increase skills of Indonesian laborers, students, and researchers through training, R&D, and internship program.

References

Asiatoday. (2020, March 13). Cadangan Minerba Indonesia Terbesar Kelima di Dunia Setelah AS, Rusia, Australia, China dan India. Retrieved from AsiaToday.id: https://asiatoday.id/read/cadangan-minerba-indonesia-terbesar-kelima-di-dunia-setelah-as-rusia-australia-china-dan-india-%EF%BB%BF

Ditjen Minerba ESDM. (2020). Laporan Kinerja Tahun 2019. Jakarta: ESDM.

PYC Data Center. (2020, June 29). Downstream Coal. Retrieved June 29, 2020, from PYC Data Center: https://datacenter-pyc.org/data/statistics/infrastructure/downstream-coal/

Sukhyar, R. (2020). Penguatan Ketahanan Industri Berbasis Nikel Indonesia. Jakarta: LK Nawacita.

*This opinion piece is the author(s) own and does not necessarily represent opinions of the Purnomo Yusgiantoro Center (PYC)